Over the last two decades, Lithuania accomplished a major transformation in the financing of energy efficiency measures in multi-apartment residential buildings. Thanks to ERDF-powered financial instruments, the country transitioned from a grant-only approach to a more strategic combination of low-cost loans and grants. This shift enables the country to address multiple national priorities, including energy poverty. These investments helped to improve the living conditions of over 83 000 households, collectively reducing 180 000 tons of CO2 equivalents.

Buildings being retrofitted in the Žaliųjų ežerų district in northern Vilnius. Participants of the recent fi-compass workshop ‘Financing RePowerEU - Shared management financial instruments combined with grants’ visited the project to exchange with stakeholders.

In a recent fi-compass podcast on REPowerEU, Kristina Vaskelienė, Business Development Officer at INVEGA, the national promotional institution of Lithuania and mandator of the ERDF-powered multi-apartment buildings modernisation fund explained: “The building sector in Lithuania is extremely energy inefficient; it ranks second after transport and that is why we really need to put a lot of effort into making this sector more performant”. In Europe, the investment needs to make multi-apartment buildings more energy efficient are substantial.

A fi-compass report assessing the investment potential in energy efficiency through financial instruments estimates a funding gap of EUR 185 billion per year over the next decade for the 27 EU countries. In Lithuania, the problem is even more pronounced. From approximately 35 000 buildings inherited from the Soviet Union, around 90% to 95% of these are rated as D, E or even F in terms of energy performance. According to the same report, this small country requires EUR 1.4 billion worth of investments, of which half is in the public sector. What is more, Lithuania has one of the highest shares of owners living in multi-family buildings after Romania, Hungary, and Slovakia.

Four multi-apartments buildings in Vilnius’ green district near the Verkiai Regional Park and one of the many successful renovation projects implemented under the ERDF-backed renovation scheme.

Transforming the building stock: an urgent national priority

When joining the EU in 2004, energy poverty in Lithuania was high, and district heating bills were a heavy burden for many households, especially low-income families living in multi-apartment buildings. To address this national priority, in 2004, the government approved a multi-apartment buildings renovation programme harnessing EU funding. At that time, the ambitious goal was to renovate 1 000 of the worst performing multi-apartment buildings so that in 2050, Lithuania would meet its GHG emission-reduction commitments while phasing out dependency on imported fossil fuels. To be economically viable, the renovations carried out had to achieve 40% energy savings, reach at least a C classification, and ensure that cumulative annual heating costs and return on investment cost after the renovation do not exceed the heating costs before renovation.

Through the ERDF-powered multi-apartment buildings modernisation fund, INVEGA exceeded the target and was able to finance the renovation of more than 1 100 multi-apartment buildings since 2015, making them more sustainable and energy efficient. Approximately 900 of them are already completely renovated. “The regulatory framework in Lithuania was a key to increase the level of energy efficiency in multi-apartment buildings. The State support scheme as well as the decision to use EU funds and attract private financing was crucial to achieve positive quantitative results”, explains Žaneta Maskaliovienė, Head of Municipalities and Housing Financing Unit at INVEGA. Her colleague Kristina Vaskelienė adds: “We, as a mandator of the funds, succeeded in raising an additional EUR 353 million using the primary portfolio of EUR 74 million as leverage, meaning that 1 Euro of EU financing resulted in 5.9 Euro of investments”.

At least 55% of apartment owners must agree on the renovation for works to be validated.

Žaneta Maskaliovienė, Head of Municipalities and Housing Financing Unit at INVEGA

The journey towards energy efficiency financing for multi-apartment residential buildings in Lithuania has been a remarkable 20-year transformation. It began as a pilot initiative and evolved through a basic grant-based programme, culminating in the implementation of effective and efficient financial instruments. Today, private finance contributes more than half of the programme’s financing, while its contribution was still zero two decades ago.

The efficiency of a ‘one-stop-shop’ model

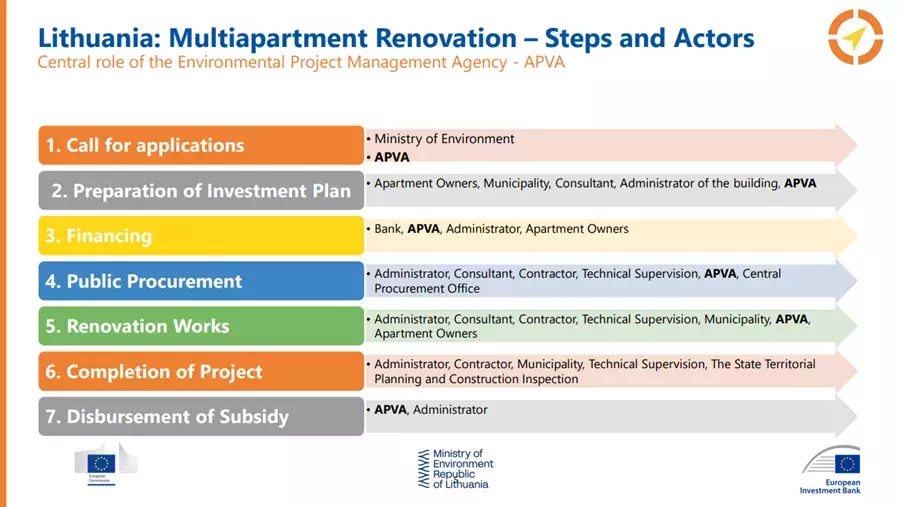

The model that Lithuania has deployed thanks to ERDF-backed financial instruments has allowed multi-apartment building owners to borrow collectively and eliminated the burden that individual loans would impose. The ‘one-stop-shop’ arrangement of this support meant that final recipients had a single contact point for the renovation project – APVA (the Environmental Project Management Agency).

The introduction of the ‘one-stop-shop’ model was one of the reasons why the number of completed projects was able to increase by a factor of five: from 479 completed projects between 2005 and 2013 to 2 460 completed projects between 2014 and 2019.

This was possible thanks to the buy-in to the renovation financing approach by building administration companies such as Atnaujinkime miestą (meaning "Let’s renovate the city”). This company is 100% owned by the Vilnius City Municipality and administers a significant number of multi-apartment residential buildings.

The ‘one-stop-shop’ approach in Lithuania.

“Atnaujinkime miestą played a key role in the successful implementation of the energy efficiency renovation scheme. They initiated and managed owners’ gatherings and facilitated decision making. Homeowners had to decide by a 55% majority if they wanted their building to be renovated under the investment scheme”

Lina Kuksėnaitė-Česnulienė, Project Manager at Atnaujinkime miestą

“The success of the scheme is also due to the fruitful collaboration between a myriad of other stakeholders, including the Government, INVEGA, APVA, the central procurement office, independent construction supervisors, certified EE certification specialists, construction companies and apartments’ owners themselves” stresses Žaneta Maskaliovienė.

Loans were granted at preferable conditions with a fixed interest rate of 3% for up to 20 years.

Once renovation works were over and expected results reached (at least a C classification and not less than 40 % energy savings), the State would compensate up to 30% of the energy efficiency investments, thus reducing the cost of renovation for each owner.

This video sheds light on the success of an ERDF-backed financial instrument in Lithuania that is helping to empower apartment owners. Through this initiative, homeowners can invest in enhancing the energy efficiency of their residences.

An additional 10% capital rebate of the project costs was possible if additional energy efficiency measures were achieved.

Combining loans with grants was another key element in the success of the multi-apartment buildings renovation scheme as it motivated financially challenged owners in signing up for the programme.

To create incentives for low-income apartment owners such as pensioners and young families, a 100% subsidy covered by the grant from the national public budget was introduced in 2013, covering all renovation costs.

This support, which is still available to date, was offered to families previously receiving state assistance for their domestic heating expenses.

The Žaliųjų ežerų district renovation project example

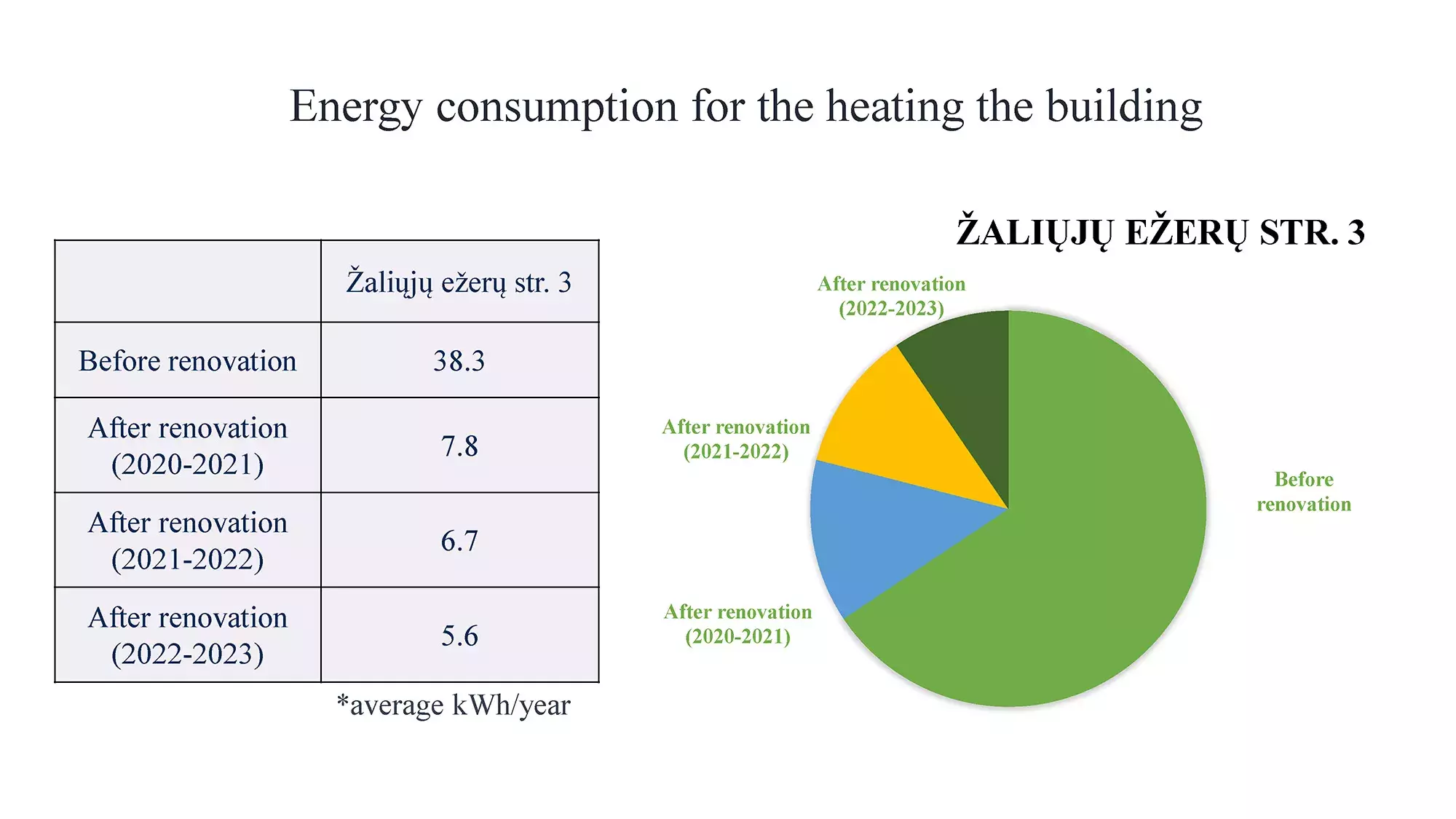

Four multi-apartments buildings in Vilinius’ green district near the Verkiai Regional Park, are one of the many examples of the successful implementation of the ERDF-backed renovation scheme. “There are 88 apartments per building on average which all were in very poor condition before the renovation. As 40 year-old buildings, they were classified as E/F in terms of energy eficency“, says Lina Kuksėnaitė-Česnulienė.

Today, six years after renovation works first started, the living conditions of the 530 apartments owners improved drastically. Their energy consumption for heating has been reduced by an impressive 70% on average, meaning heating bills are reduced by 40% and above all, the apartments are warmer and cosier to live in.

Lithuania is an example of an effective and well-coordinated system that was put in place to provide technical support to each stakeholder at every stage of planning and implementation.

“There were houses where the temperature would not go above 17°C. Today, they are classified as C and the savings in heating bills had an immediate, positive impact on the everyday life of owners as energy costs in 2022 were weighing heavily on the domestic budgets of many Lithuanian families”.

Lina Kuksėnaitė-Česnulienė, Project Manager at Atnaujinkime miestą

Example of the energy consumption decrease following the renovation of Žaliųjų ežerų str. building.

The renovation works include the standard features that you would expect: thermal insulation of roofs, walls and the basement ceilings; the glazing of loggias, installation of new doors and windows; upgrading of heating; ventilation and water drainage systems; and the installation of new elevators. An estimation post-renovation works indicates that the market value of the apartment has increased by between 15% and 25% while the buildings’ lifetime was extended by around 20 years.

Participants of the recent fi-compass workshop in Vilnius were able visited the Žaliųjų ežerų district renovation project and exchange with stakeholders. Slides from the presentation are available here.

More ERDF-backing to come

INVEGA have moved into the 2021-2027 programming period well prepared and with many ambitions: “According to the agreement on the addition of the Apartment House Modernisation Fund between INVEGA, the Ministry of Finance and the Ministry of Environment, the total financing of projects in need of support amounts to EUR 960 million. So far, we have received EUR 192 million from the ERDF and Cohesion Fund.

INVEGA will need to attract more than EUR 750 million private funding”, says Žaneta Maskaliovienė while she adds: “For the moment we have received more than 350 applications from project administrators. We hope that EU money and private funding will help to modernise more than 1 000 multi-apartment buildings”.

Financing with EIB-managed European funds

To address energy poverty in Lithuania, the government set up a national programme for investment in energy efficiency in public buildings and social housing. It was a grant scheme that did not include any ERDF resources. The energy efficiency renovation of multi-apartment residential housing in Lithuania took off with the launch of the JESSICA initiative (Joint European Support for Sustainable Investment in City Areas). JESSICA was a European Commission and the European Investment Bank (EIB) initiative in the 2007-2013 programming period that aimed to promote investments in sustainable urban development projects across the EU.

In 2009, the managing authority mandated the EIB to set up financial instruments under the JESSICA initiative. With this, Lithuania became a pioneer in the EU for using financial instruments to finance the energy efficiency renovations of their multi-apartment residential housing stock. The success of this first generation of financial instruments paved the way to the early launch of a second generation of financial instruments. The Jessica II fund of funds was set up by Lithuania’s Ministry of Finance and Ministry of Environment early in the ERDF 2014-2020 programming period.

The financial instruments have supported the development of a single product for homeowners known as the ‘Modernisation Loan’ and the centrepiece of the Lithuanian government’s programme to improve energy efficiency in residential properties.

The Modernisation Loan programme is also supported by a capital and technical assistance grants and a ‘one-stop-shop’ service arrangement that has been key to the successful delivery of the financial instruments.

So far, under EIB management, loans have been extended to about 3 300 buildings for close to EUR 1.2 billion. These investments helped to improve the living conditions of over 83 000 households, collectively reducing 180 000 tons of CO2 equivalents.

The latest instrument implemented by the EIB to support renovation is a EUR 475 million investment platform, which attracted investments from the Nordic Investment Bank (NIB), the European Bank for Reconstruction and Development (EBRD), the Council of Europe Development Bank (CEB), “Swedbank”, and Šiaulių bankas as well as a local pension funds.

A new mandate for the 2021-2027 programming period, under which a new platform of EUR 500 million will be set up, is planned to be signed with the Government in mid of 2024.