| |

| |

| |

State aid guidance for financial instruments is now available from the European CommissionWhen Member States give aid through financial instruments (co‑)financed by the European Structural and Investment Funds, compliance with State aid rules is necessary in order to encourage economic efficiency and prevent that public support unduly distorts competition.

A Staff Working Document has been published by the European Commission to facilitate the application of State aid rules in the field of financial instruments and to point to different possibilities of achieving State aid compliance. The Staff Working Document can be downloaded and shared from the EC Regulatory Guidance section of the fi‑compass website.

Read more |

|

| |

| |

|

|

| |

| |

Online advice about reporting requirements for financial instruments Practical advice for managing authorities about financial instrument reporting requirements have been provided recently through a new type of advisory service from fi‑compass.

In our online learning seminar, European Commission experts explained how to fulfil the mandatory reporting obligations required under Article 46 of the Common Provisions Regulation (No 1303/2013, CPR), using video presentations and a series of step‑by‑step instructions based on the annotated reporting template.

Managing authorities were invited to submit their questions about the reporting requirements and template sections in advance of the seminar. This helped to address a wide range of queries from Member States on different topics related to reporting.

Read more |

| |

Dutch financial instrument promotes high-tech business innovation A new fi‑compass case study shows how a financial instrument from the Eastern Netherlands has used European Regional Development Fund assistance to support innovation investments by small and medium‑sized enterprises (SMEs).

This 'Innovation Fund East Netherlands' was designed to help improve access to finance for the region's most promising entrepreneurs during the global economic crisis.

The fund manager, Participatiemaatschappij Oost (PPM Oost), provided equity and loans that many banks, venture capitalists, and business angels were considering too high risk.

PPM Oost also offered networking, training, and coaching opportunities. Results led to 33 SMEs investing EUR 25.7 million which created 325 new jobs.

Read more |

| |

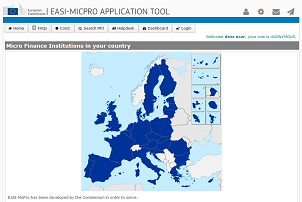

The EaSI Helpdesk on microfinance is live The European Commission in the frame of its Employment and Social Innovation (EaSI) Programme has launched a fully renovated Helpdesk, which will assist all institutions interested in European microfinance.

The service is addressed to microfinance providers and guarantee institutions, public and private banks, local and regional authorities, networks, business incubators and research centres from EU Member States, Candidate and Potential Candidate countries, and EFTA countries.

Read more |

|

|

|

|

|

|

| |

|

|

| |

| |

European Social Fund financial instruments supporting self-employment and entrepreneurship Vienna saw the first thematic fi‑compass workshop on European Social Fund (ESF) financial instruments supporting self‑employment and entrepreneurship under Thematic Objective 8. This full day workshop was attended by representatives from ESF managing authorities, financial intermediaries, and other stakeholders from across the EU.

Read more |

| |

Raising awareness about Europe's venture capital landscape Venture capital can be defined as a subset of private equity that is co‑invested with an entrepreneur to fund a business venture, normally during its early‑stage (seed or start‑up) and expansion phases. Higher‑than‑average returns on such investments tend to be expected by venture capitalists and investors in order to offset higher risk in these investments.

Read more |

| |

Rural development loans, guarantees and equity under the spotlight in Estonia Estonia, currently holding the Presidency of the Council of the EU, hosted our sixth EAFRD fi‑compass macro‑regional conference on financial instruments for agriculture and rural businesses, supported by the European Agricultural Fund for Rural Development (EAFRD). In total, 85 participants from 17 different Member States attended the conference on 12 July 2017 in Tallinn.

Read more |

| |

Agricultural Multi-Regional Guarantee Platform launched for Italian farmers Italy is establishing an innovative 'Agricultural Multi‑Regional Guarantee Platform' as a ground‑breaking new financial instrument investing initially EUR 68 million from the European Agricultural Fund for Rural Development and national co‑financing resources.

Read more |

|

|

|

|

|

| |

|

|

| |

| |

Microcredit providers meet in Venice Capacity building workshops for EU microcredit providers (MCPs) were organised in June by fi‑compass using the European Commission's Employment and Social Innovation Programme's Technical Assistance (EaSI TA). MCPs from across the EU and elsewhere came together in Venice for these EaSI TA workshops as part of the European Microfinance Network's 14th annual conference.

EaSI TA workshop sessions provided an opportunity for the MCPs to share their experiences with peers and to learn more about how MCPs operate in different countries and sectors.

We spoke to some of the workshop participants about their roles in providing microcredit and how EaSI TA has helped their organisations.

Read more |

| |

Investing in low carbon economies: Lessons from the London Green Fund Our fi‑compass publications library includes a case study from the London Green Fund (LGF). It explains how this financial instrument used the European Regional Development Fund (ERDF) to successfully support much‑needed investments in environmental infrastructure.

This ERDF financial instrument contributes directly to reducing carbon emissions and it received international recognition earlier this year when its urban development achievements were discussed at the C40 Financing Sustainable Cities Forum. The story behind this success was told by the LGF fund managers and the Greater London Authority (GLA), the ERDF Intermediate Body.

Simon White from the GLA explained how the financial instrument was primarily driven by targets for minimising carbon emissions and waste within the city's urban regeneration plan, saying: "There were lots of projects that needed to be delivered, and there were lots of finance that needed to be secured to enable those to happen."

A solution to this challenge involved a shift in approach to develop a fund that used the ERDF as investment finance to support infrastructure projects.

Read more |

|

|

|

|

|

| |

|

|

| |

| |

Advance notice: 'FI Campus' flagship event from fi-compass New learning opportunities about financial instruments using the European Structural and Investment Funds (ESIF) are being planned by fi‑compass for later this year. These include a large‑scale event spanning over several days that will cover a wide range of topics related to ESIF financial instruments.

Read more |

| |

Financial instruments workshop at 'The European Week of Regions and Cities' In the framework of the European Week of Regions and Cities, the European Commission's Directorate‑General for Regional and Urban Policy is organising a workshop titled: 'Financial Instrument as a delivery mechanism for ESIF post 2020'. This workshop will contribute to the debate on the role of financial instruments in delivering cohesion policy in post 2020.

Read more |

| |

Financial instruments for fisheries and aquaculture Fisheries financial instruments will be given prominence during an EU conference in October that is considering the future of the European Maritime and Fisheries Fund. A dedicated workshop on financial instruments has been organised in Estonia on October 13 as part of the 'Beyond 2020: Supporting Europe's Coastal Communities' conference.

Read more |

|

|

|

|

|

|

Update your fi-compass profile

In order to help us to better tailor fi-compass activities to the needs of our users we ask readers to update their registered profiles on the fi-compass website. We are especially keen to update our understanding of what topics you would like to know more about concerning financial instruments, as well as what you already know about financial instruments. You can update your profile here. |

|

|