The third edition of the annual fi-compass flagship event, ‘FI Campus’, organised by the European Commission (DG REGIO, DG EMPL, DG AGRI and DG MARE) in partnership with the European Investment Bank (EIB), took place in Brussels on 4-5 December 2019. The conference, which had the theme ‘Looking ahead to 2021 and beyond’, attracted over 400 participants from managing authorities, financial intermediaries and other stakeholders from 26 Member States.

The event was opened by Eric von Breska, Director of the Policy Directorate at the Directorate-General for Regional and Urban Policy (DG REGIO) of the European Commission, and Simon Barnes, Head of Advisory Services at the EIB. Eric von Breska highlighted in his opening speech the importance of ESIF financial instruments in the next programming period. Looking ahead to 2021 and beyond, he commented that “there is significant potential for a wider uptake of financial instruments by expanding beyond loans, the most common financial product, and beyond support to SMEs or energy efficiency.” Simon Barnes also emphasised the theme of the event saying, “now is the time to start planning for the use of financial instruments in the next programming period,” which, he added, “provides us with an opportunity to further extend the benefits of financial instruments to both existing and new sectors.”

The strong positive impact of ESIF financial instruments was the main theme of the keynote speech delivered by Luigi Amati, CEO of META Group, a fund manager involved in financial instruments co-financed with European Regional Development Fund (ERDF) resources in a number of Member States. Beneath the one-word message ‘CONNECT’, the keynote speaker discussed the importance of mobilising equity investment to support high growth start-ups and growing businesses across Europe.

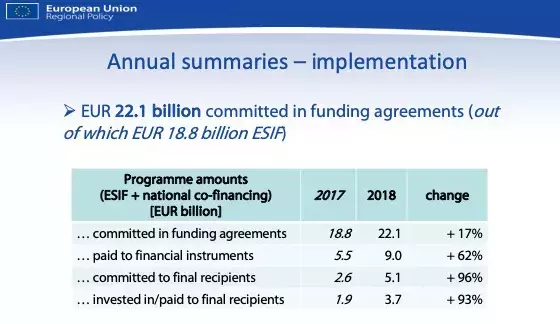

Jonathan Denness, Head of Financial Instruments and International Financial Institutions Relations Unit, DG REGIO, European Commission presented at FI Campus 2019 a first preview of the summary of the data on the progress made in financing and implementing the financial instruments for the programming period 2014-2020. According to the 2018 annual summaries data, EUR 22.1 billion was committed in funding agreements, of which EUR 18.8 billion came from ESIF resources. This is an increase of 17% in programme amounts compared to the 2017 data. Furthermore, compared to the 2017 data, the programme amounts paid to financial instruments increased by 62%, whilst sums committed to final recipients increased by 96% and amounts invested in or paid to final recipients increased by 93%.

Frank Lee, Head of Financial Instruments Advisory Division, EIB, subsequently discussed the results of the current fi-compass stock-taking study on financial instruments in certain sectors, including the analysis of the main challenges identified, the sectors with the highest potential and recommendations on how to foster the update of ESIF financial instruments in 2021-2027. The results of the fi-compass study will be published in early 2020.

The proposed new Common Provisions Regulation (CPR) for the 2021-2027 programming period was presented by representatives from the European Commission, DG REGIO’s Financial Instruments and International Financial Institutions Relations Unit. The session, which was divided into three thematic blocks (programming, implementation and other aspects), also included contributions from Bpifrance, the Lithuanian national promotional institution, Invega and the EIB Group.

This was followed by a presentation on the InvestEU programme by experts from DG REGIO and the European Commission’s Directorate-General Economic and Financial Affairs (DG ECFIN). After a general overview of the programme, InvestEU’s Member State compartment was discussed in detail, with additional contributions from the Bank Gospodarstwa Krajowego (BGK) from Poland and the EIB Group.

During the two interactive afternoon sessions, participants were encouraged to ask their questions and provide their views about the topics to the experts. At the end of the event Jonathan Denness invited participants with additional questions related to the European Commission’s presentations at FI Campus on the CPR and InvestEU, to contact the following email address: REGIO-B3-FINANCIAL-INSTRUMENTS@ec.europa.eu.

The second day of FI Campus 2019 opened with parallel sessions focusing on the exchange of experiences with financial instruments co-financed by the different ESI Funds. Within these sessions, Member State experiences in a wide range of sectors were presented by experts from managing authorities, financial intermediaries and other stakeholders from Portugal, Greece, France, Italy, Latvia, Finland, Estonia, Germany, the European Crowdfunding Network, the Enterprise Europe Network, the European Commission and the EIB Group. In addition, a brainteaser session on practical issues of deploying financial instruments gave participants an opportunity to test their know-how and discuss practical questions amongst each other.

Participants could also deepen their knowledge on State aid as well as audit and control of ESIF financial instruments in two workshops led by European Commission experts. In parallel with those sessions, two fishbowl discussions with financial intermediaries allowed participants and experts to share some of the key practical challenges and lessons learnt in relation to managing debt and equity financial instruments.

For the first time this year, FI Campus 2019 featured ten shortlisted stories submitted to the fi-compass Showcase 2019, each highlighting the positive impact of ESIF financial instruments in their Member State or region through examples of final recipients and what they were able to achieve with the support received. FI Campus 2019 participants were invited to vote for their favourite story during the event. The three stories with the most votes who received the fi-compass Showcase Award 2019 in a short ceremony during the closing session of FI Campus were as follows:

To encourage peer-to-peer exchanges between participants, an online networking platform was launched before the FI Campus event allowing participants to get in touch with each other and set up short ‘face-to-face’ meetings at the event. This platform will remain live until the end of February 2020 (at the earliest) to allow FI Campus 2019 participants to stay connected and continue to share experiences and exchange on the ESIF financial instruments topics featured at the event.

![]() presentation

presentation

![]() audio

audio

![]() video

video

![]() case study

case study

The audio in the video files is in original language of the speakers. The English interpretation is available as audio files.

| Title | Speakers | ||

|---|---|---|---|

ESIF financial instruments: annual summary and outcomes of the fi-compass stock-taking study |

|||

| ESIF financial instruments: results of annual summaries | Jonathan Denness, Head of Unit, Directorate- General for Regional and Urban Policy, European Commission |

||

| Stock-taking on financial instruments in certain sectors | Frank Lee, Head of Financial Instruments Advisory Division, European Investment Bank |

||

The proposed new Common Provisions Regulation (CPR): presentation of the legislation – interactive session |

|||

| The proposed new Common Provisions Regulation (CPR) | Axel Badrichani, Deputy Head of Financial Instruments and International Financial Institutions Relations Unit, DG REGIO, European Commission Oana Dordain, Policy Officer, Financial Instruments and Relations with International Financial Institutions Unit, DG REGIO, European Commission Ieva Zālīte, Policy Officer, Financial Instruments and Relations with International Financial Institutions Unit, DG REGIO, European Commission In case of additional questions related to the European Commission’s presentations at FI Campus on the CPR, please contact: REGIO-B3-FINANCIAL-INSTRUMENTS@ec.europa.eu |

||

New CPR: INVEGA's experience and proposals |

Inga Beiliūnienė, Head of Project Management Division and Deputy CEO, INVEGA, Lithuania |

||

Implementing ERDF financial instruments |

Céline Nguyen, Responsible of European Structural and Investments Funds Financing, Bpifrance, France |

||

The proposed new Common Provisions Regulation (CPR): EIB Group perspective |

Ioana Morar-Iliescu, Mandate Management, European Investment Fund Mariateresa Di Giacomo, Team Leader, DFI Coordinator, Mandate Management, European Investment Bank |

||

InvestEU: presentation of the Programme – interactive session |

|||

InvestEU Programme |

Jacek Truszczyński, Policy Coordinator, DG ECFIN, European Commission Tsvyatko Velikov, Policy Analyst, Financial Instruments and Relations with International Financial Institutions Unit, DG REGIO, European Commission In case of additional questions related to the European Commission’s presentations at FI Campus on InvestEU, please contact: REGIO-B3-FINANCIAL-INSTRUMENTS@ec.europa.eu |

||

InvestEU: presentation of the Programme in Poland |

Agnieszka Falkowska, Director of Project Finance, Bank Gospodarstwa Krajowego (BGK), Poland |

||

InvestEU – MS Compartment: presentation of the Programme |

Andra Migiu, Mandate Officer at Mandate Development, European Investment Bank |

||

Case study and roundtable sessions 1: ERDF financial instruments supporting urban development in the low carbon economy |

|||

| |

Financial instruments for urban development in Portugal – IFRRU 2020 | Abel Mascarenhas, President of the Executive Board of IFRRU 2020, Portugal Maria Albuquerque, Senior Specialist, IFFRU 2020, Portugal |

|

| |

Energy Efficiency in existing Housing Programme ΕΧΟΙΚΟΝΟΜΟ I & II | Christos Drymousis, Programme and Evaluation Unit, Managing Authority of OP “Competitiveness, Entrepreneurship and Innovation”, Greece Achilleas Tilegrafos, Executive Authority of the Partnership Agreement, Energy Sector Ministry of Environment & Energy, Greece |

|

Case study and roundtable sessions 2: ERDF financial instruments supporting SMEs, including research, development and innovation (RDI) |

|||

La Financière Région Réunion |

Aubin Bonnet, European Investment Fund |

||

APICAP: invest different |

Alain Esnault, President, APICAP, France Zaynah Amourani, Partner, APICAP, France |

||

JSC Development Finance Institution Altum, financial instruments 2014-2020 |

Juris Vaskāns, Member of the Board of Directors, Altum, Latvia |

||

ZGI Capital – Growth fund strategy supported by ALTUM |

Normunds Igolnieks, Chief Executive Officer, ZGI Capital, Latvia |

||

The MIUR R&I Fund of Funds |

Anna Maria Fontana, Manager in charge of Financial Instruments, Agenzia per la Coesione Territoriale, Italy |

||

Enterprise Europe Network and the support to SMEs in the ERDF OP |

Raffaella Bruzzone, Enterprise Europe Network |

||

Case study session 3: ESF financial instruments: student loans |

|||

| |

Overview of ESF FIs for student loans |

Eugenio Saba, Financial Instruments Advisor, European Investment Bank |

|

ESF financial instruments: student loans – the Portuguese experience |

Cristina Jacinto, Executive Board Member, Human Capital Operational Programme, Portugal Marco Neves, Executive Board Member, Sociedade Portuguesa de Garantia Mutua, Portugal |

||

Skills and Education EFSI Guarantee Pilot – Paving the way into #InvestEU |

Chiara Amadori, Head of the Competence Centre for Culture and Education within the EU Guarantee Facilities Division, European Investment Fund |

||

Roundtable session 4: EAFRD financial instruments for post-2020 and overview of current developments |

|||

| EAFRD financial instruments, InvestEU & the post-2020 debate | Michael Pielke, Head of Unit, DG AGRI, European Commission |

||

EIF financial instruments in agriculture |

Alessandro Gargani, Business Development and Mandate Manager, European Investment Fund Balazs Podmaniczky, Mandate Manager, European Investment Fund |

||

| fi-compass support for EAFRD managing authorities | Mario Guido, Financial Instruments Advisor, European Investment Bank |

||

Session 5: EMFF financial instruments - taking stock of the 2014-2020 experience and looking post-2020 |

|||

EMFF Financial Instruments in Shared Management |

Richard Croft, Policy Officer, CFP and Structural Support, Policy Development & Coordination Unit, DG MARE, European Commission |

||

EMFF ex-ante assessment |

Heta Ratasvuori, Senior Specialist, Fisheries Industry, Ministry of Agriculture and Forestry, Natural Resources Department, Finland |

||

| |

Estonian experience with FI for the fisheries and aquaculture sector 2014- 2020 and looking post 2020 |

Eduard Koitmaa, Ministry of Rural Affairs of the Republic of Estonia, Fisheries Economics Department, Market Regulation and Trade Bureau, Managing Authority of EMFF OP |

|

Outcome of the fi-compass survey on the use/no-use of FIs under the EMFF |

Miglena Dobreva, Financial Instruments Advisor, fi-compass team, FIA Division, European Investment Bank |

||

Session 3: New ideas for financial instruments under ESF – Crowdfunding |

|||

ESF and crowdfunding New opportunities for managing authorities |

Francesca Passeri, Head of Advocacy, European Crowdfunding Network Eugenio Saba, Financial Instruments Advisor, European Investment Bank |

||

Combining ESIF financial instruments and crowdfunding |

Irene Schucht, Head of Strategy and Products, Investitionsbank Berlin, Germany |

||

Workshop 1: State aid |

|||

State aid rules applied to financing and investment operations supported by InvestEU Fund |

Andrea Bomhoff, Head of Unit, State aid and Financial institutions Relations Unit, DG COMP, European Commission |

||

State aid Knowledge Hub: main takeaways from meeting |

Barbara Cattrysse, Senior Legal Counsel, European Investment Bank |

||

| Effect on trade in the light of the Marinvest judgment | Péter Staviczky, Attaché responsible for State aid, Permanent Representation of Hungary to the European Union |

||

Fishbowl discussion 1: Equity instruments |

|||

| The Greek EquiFund paradigm | George Giakoumakis, European Investment Fund |

||

The Greek startup ecosystem and the impact of EquiFund |

George Dimopoulos, Partner, Venture Friends, Greece |

||

Workshop 2: Audit and control |

|||

Audit and control in financial instruments 2014-2020 |

Rafael Lopez Sanchez, Deputy Head of Unit C.1 – Coordination, relations with the Court of Auditors and OLAF, DG REGIO, European Commission Vladislava Glietz, Team leader for audit methodology, Unit C.1 – Coordination, relations with the Court of Auditors and OLAF, DG REGIO, European Commission |