Key market features

Guarantee financial instruments

The portfolio guarantee model

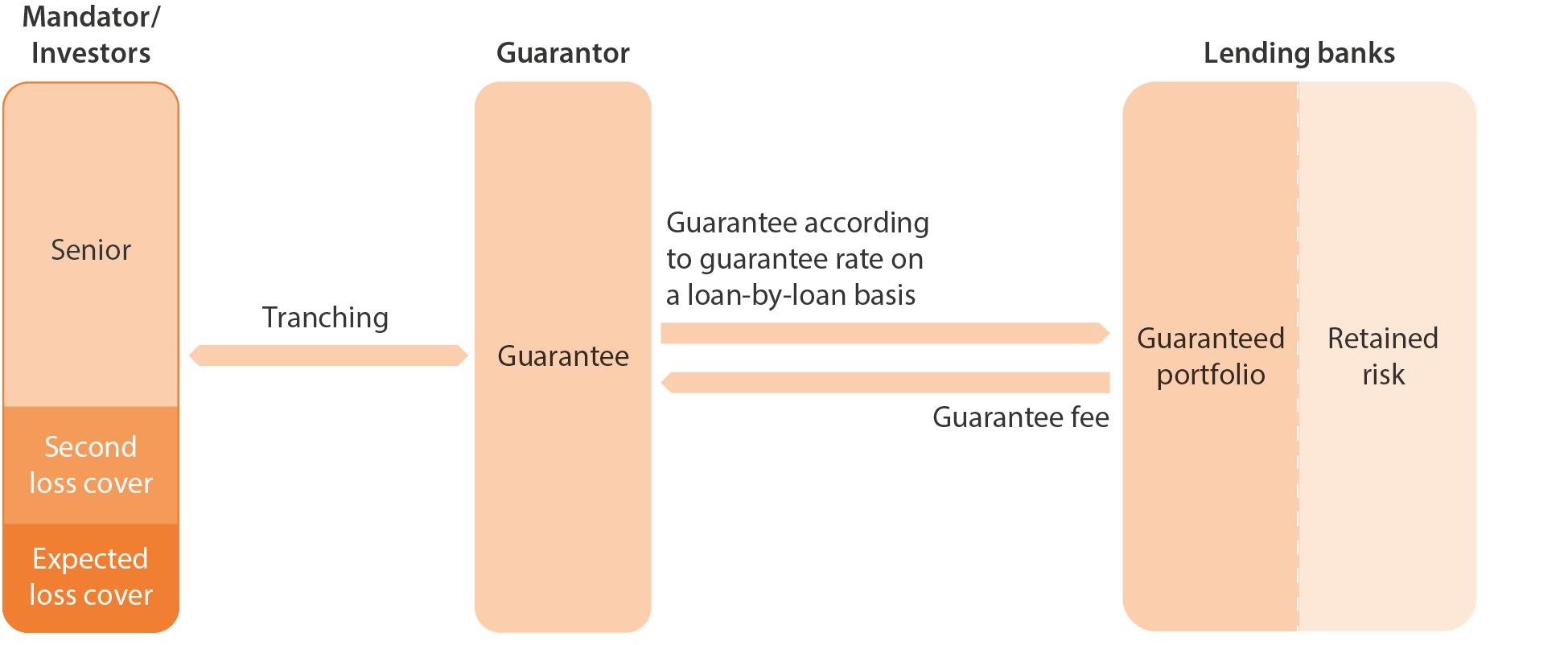

In a portfolio guarantee model, the guarantee may be provided by a single guarantor or several different investors.

Where there are a number of investors, the risk coverage is split between the mandators/investors via tranching mechanisms, differentiating the junior, mezzanine and senior risk-takers.

The junior tranche is the riskiest layer of the guarantee, absorbing losses before and claiming recoveries after both the senior and mezzanine tranches. In contrast, the senior tranche is the first layer of the guarantee, covering the most secure and least risky portion of the portfolio. Senior tranches have the highest claim on recoveries in case of default.

Figure 6: the Portfolio Guarantee model

The lending banks, while building up their portfolio of loans, would benefit from a portion of the portfolio secured by the guarantee in accordance with the guarantee rate. At the same time, the lending banks retain the risk with respect to the remaining portion of the portfolio.

The guarantee fee (risk premium), if applicable, is a function of capital structure and pricing of each risk taker. However, there are structures (typically in case of first loss portfolio guarantees) where the guarantee can be provided free of charge.

After the deadline agreed with the lending banks for guarantees to be called for defaulted loan transactions, the banks should return the part of the contributions that are not intended to cover possible guarantee calls to the guarantor.

As a result of the guarantee, if a default occurs at the level of final recipients, the loss to be borne by the body implementing the financial instrument can be significantly reduced.

Transfer of benefit in case of guarantees

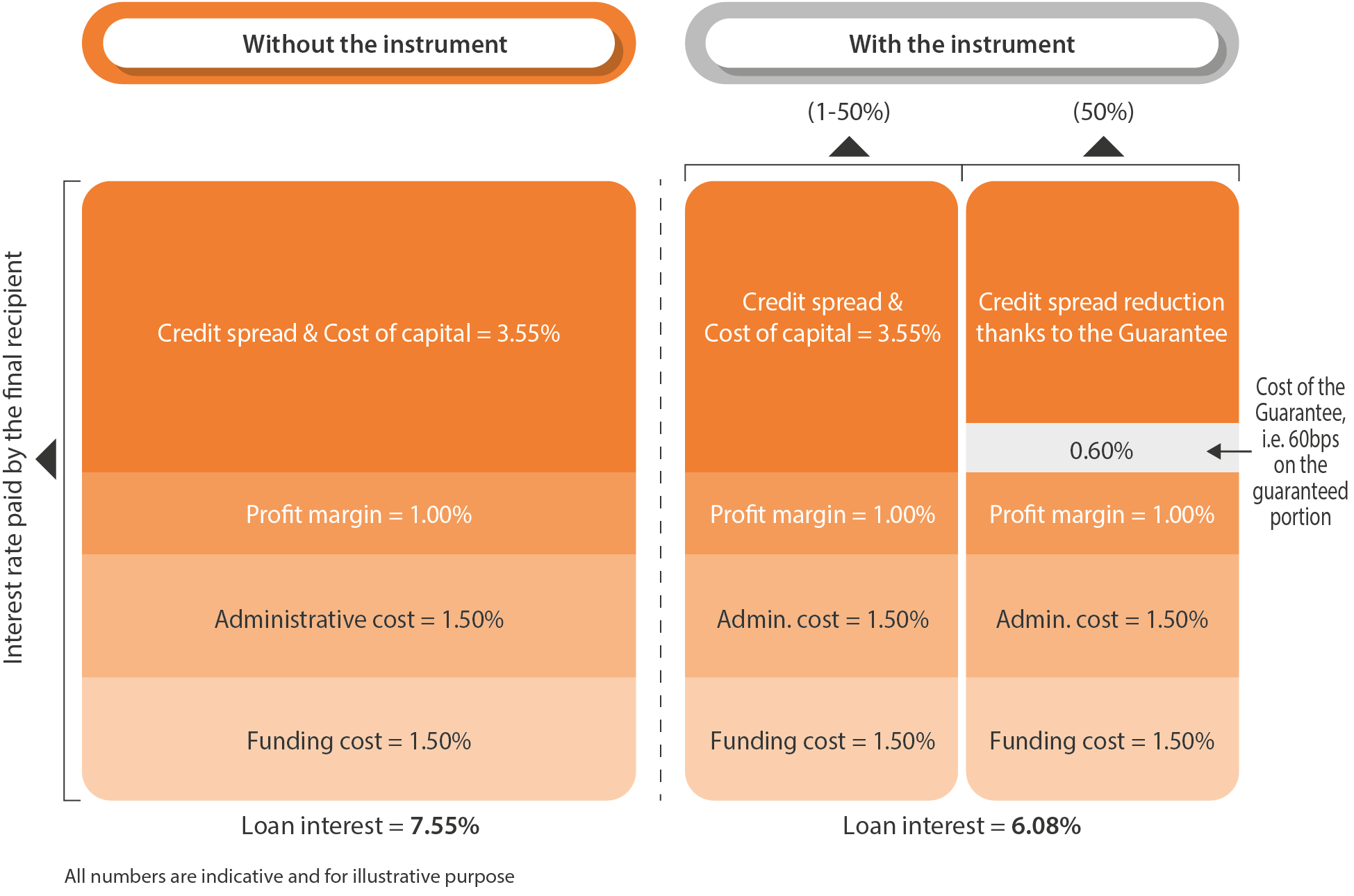

The mechanism to reduce interest rates operates to treat the guarantee as a credit enhancement, mitigating the perceived risk associated with the loans and consequently leading to a reduction in the credit spread.

The credit spread reflects the risk premium added to the interest rate to account for the borrower's creditworthiness. Higher-risk borrowers typically face a higher credit spread.

The guarantee alleviates the risk linked to the guaranteed portion of the loan, resulting in the decrease in the credit spread and ultimately in the overall loan interest compared to the standard market rates.

Figure 8: Mechanism of interest rate reduction as a result of the transfer of benefit

AL VIA – an ESIF guarantee instrument for Smart SMEs in Lombardy, Italy

Founded in 2017, the Italian region of Lombardy’s AL VIA programme has taken important steps to help revive the regional economy in the wake of the financial crisis. The AL VIA financial instrument provides mid- to long-term assistance to small and medium-sized businesses in the form of loans and guarantees, releasing up to EUR 370 million of financing.

The long- and medium-term loans provide between 85% and 95% of an investment, with guarantees covering 70%. Grants, made available through the Lombardy ERDF ROP, can be used to cover 5-15% of the agreed investment.

The initiative has mobilised EUR 262 million for loans backed by EUR 65 million guarantee from the Lombardy ERDF ROP 2014-2020, and a further EUR 43.4 million was committed as grants from the Lombardy ERDF ROP 2014-2020.

Guarantees in combination with grant

Grants can be combined with guarantee financial instruments to meet a number of different types of needs of final recipients, allowing the product to be tailored to the local market. Typically these include:

Interest rate subsidies: interest rate to be offered to the final recipient can be further reduced by offering an interest rate subsidy to cover some or all of the price payable in respect of the portion of the loan not funded from ERDF programme resources.

Technical support grant: the body implementing the financial instrument may pay grant to a final recipient (or to another body for the benefit of the final recipient) for the preparation and/or the implementation of the project (e.g. grant to cover the costs of an energy audit performed before and/or after the renovation works).

Capital grant: where the body implementing a financial instrument provides the final recipient with a grant to meet part of the investment cost, for example where a proportion of the project is non-revenue generating.

Capital rebate: where the grant is used to repay early/write off part of the principal. This mechanism is often linked to the achievement of a specified target (e.g. regarding the energy performance of the new project).

Guarantees in combination with grant

The fi-compass factsheet, published in May 2021, explores the different possibilities for combining grant with loan, equity and guarantee financial instruments.

The factsheet describes how a number of different types of grant support including interest rate subsidies, technical support, capital grant and capital rebates can be combined with loan, guarantee and equity financial instruments in a single operation.

Governed by financial instrument rules, combined financial instrument-grant operations are expected to play an important part in scaling up the use of financial instruments to support Cohesion policy in the 2021-2027 period.

The factsheet describes the options available under the regulations and gives practical examples of how the flexibilities can be applied in practice.

Energy Efficiency and Renewable Energy Malta

In 2018, the Maltese authorities decided to commit EUR 15 million from its Operational Programme I – ‘Fostering a competitive and sustainable economy to meet our challenges’ (EUR 12 million from ERDF and EUR 3 million from national resources) to the EIF to set up a fund of funds for projects of energy efficiency and renewable energy.

The guarantee is provided by the EIF to two selected financial institutions to cover part of their risks for newly originated loans provided to households and enterprises (entrepreneurs, SMEs, mid-caps) in relation to EE and RE investments in Malta. The guarantee is expected to leverage financing of EUR 45 million to final recipients.

The financial instrument includes a grant component in the form of interest rate subsidies of up to 2.5% p.a. for 10 years. The overall contribution of the grant component is EUR 4.7 million. In addition, a support package has been set up by EIB Advisory for financial institutions, which consists of an automatised webtool for eligibility check and reporting and tailored bilateral support (coaching, pipeline building, project development, eligibility assessment, project reporting).