Background to guarantee financial instruments

A market perspective

Bank lending remains the prevalent form of external financing in almost all jurisdictions. However, banks' lending capacity has been affected by the European banking sector's implementation of Basel III reforms, requiring a 25%-30% increase in capital. Additionally, the increased interest rates since 2022 have impacted banks' ability to extend loans to SMEs, leading to higher borrowing costs, reduced loan demand and pressure on profitability margins.

From the demand side, smaller and younger SMEs generally face more difficulties in accessing debt financing, due to the lack of credit history and shortage of personnel assigned to acquire financing. Innovative SMEs in particular often face also greater difficulties because they have very limited tangible assets that could be offered as collateral for the debt financing. The same is true for SMEs in new sectors such as circular economy, social economy and/or the cultural and creative sector.

Guarantee instruments can address both medium- and long-term needs for investments mainly for investments in infrastructure or fixed assets, and short-term needs for working capital. Their effectiveness as a tool to mobilise financing was illustrated in several Member States during the COVID-19 pandemic when guarantee instruments were repurposed and expanded to support companies affected by the crisis as part of the European Commission’s Coronavirus Response Investment Initiative (CRII and CRII Plus).

SIH Anti-Corona Guarantee, Slovakia

The Slovak Investment Holding (SIH) Anti-Corona Guarantee was launched in Slovakia in the second part of 2020. The purpose of the instrument was to provide favourable-term bridging loans to SMEs impacted by the COVID-19 crisis.

The guarantee was one of the first products introduced in the EU after the COVID-19 outbreak. It was funded by the Operational Programme ‘Integrated Infrastructure’ with ESIF resources co-financed by the national budget.

The financial instrument consisted of two components. First, a first loss portfolio guarantee with 80% guarantee coverage on individual loans and a 50% guarantee cap rate at the level of the portfolio. Secondly, an interest rate subsidy of up to 4% for those enterprises that manage to preserve existing jobs.

Debt instruments vs. Equity instruments

Debt financing and equity financing are two fundamentally different approaches to support businesses. These instruments differ significantly in their terms, structures and implications.

Guarantee instruments vs. loan instruments

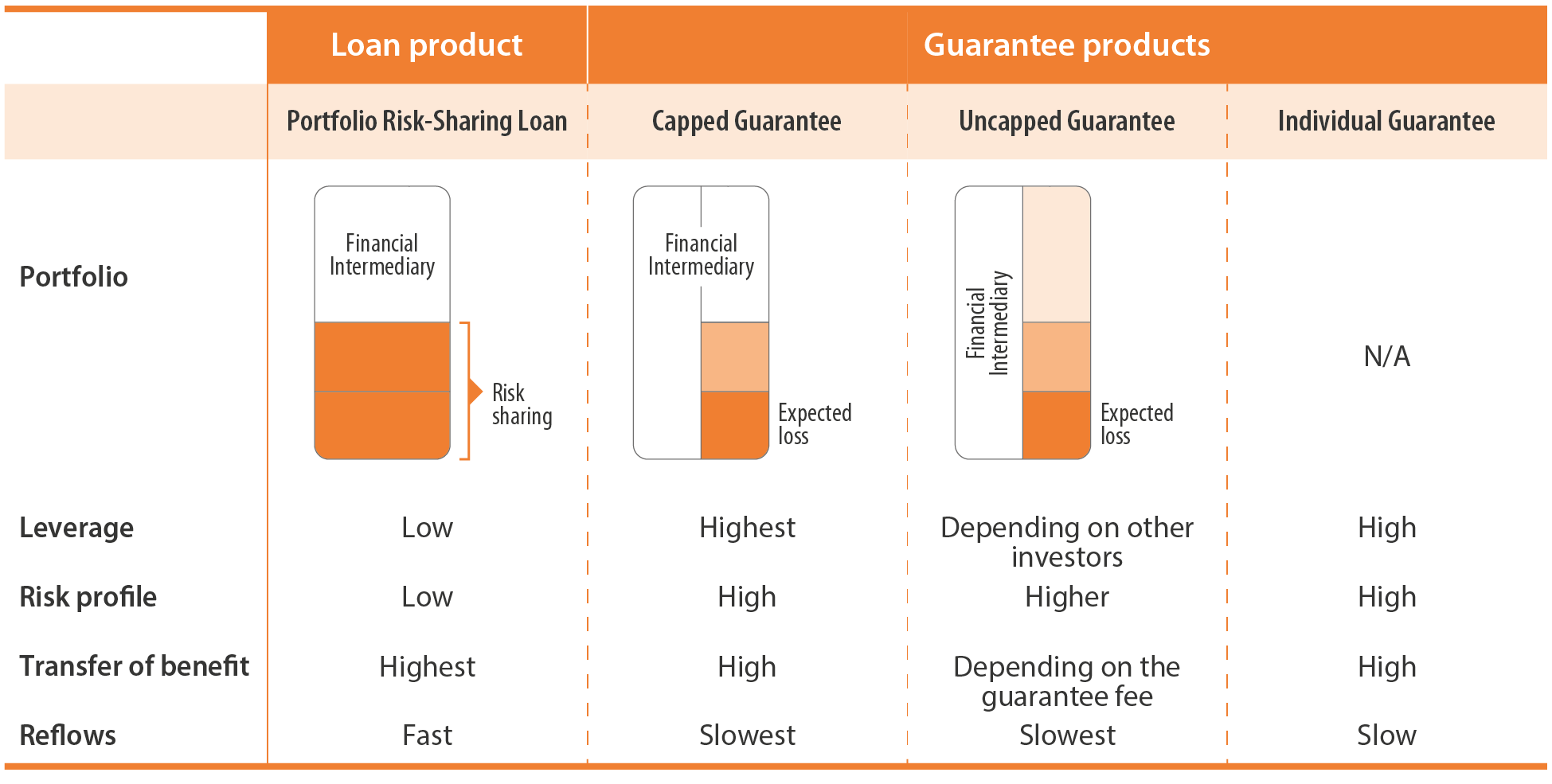

Guarantee products usually have higher leverage rate than funded products due to the multiplier effect. This also means that the instrument can be launched with relatively small contribution from the managing authorities. On the other hand, the reflows are slower for guarantees than for loan instruments, therefore the re-use of funds would take longer. The guarantee represents a risk reserve for the lender and does not provide liquidity. Consequently, if banks require higher levels of liquidity, loan instruments would be a more suitable choice to address the market's needs.

The choice of financial product and the investment strategy to pursue depend on various factors, including the managing authority's goals (for example, whether liquidity or rather leverage is the main requirement), the portfolio profile and the risk appetite in the market.

For example, guarantee instruments can be useful means of financing when the collateral requirements by commercial banks are high, where there is risk-aversion to finance riskier projects in the market, or a tightening of lending conditions stemming from regulatory requirements.

Comparing financial products

Figure 5: Comparison of financial products

FMFIB – Strategic use of guarantees and loan financial instruments for SMEs

The Fund Manager of Financial Instruments in Bulgaria (FMFIB) is a holding fund that manages EU shared management resources through 13 different financial instruments on behalf of five Bulgarian managing authorities.

FMFIB initially set up several targeted loan financial instruments under the ERDF ‘Innovation and Competitiveness’ Operational Programmes to complement the large guarantee programme being delivered under the SME Initiative.

Debt market analysis – market conditions in EU macro regions

The debt financing gap for SMEs (estimated at EU level at EUR 176.7bn) remains high despite the provision of support from both EU centrally managed instruments as well as those using national programme resources.

Click on the orange dots below to see the results for selected Member States.