Introduction to ERDF guarantee financial instruments

Definition of guarantee financial instruments

“A written commitment to assume responsibility for all or part of a third party's debt or obligation or for the successful performance by that third party of its obligations if an event occurs which triggers such guarantee, such as a loan default.”

A guarantee financial instrument supports lenders to provide debt financing to final recipients by covering a part of the risk of default.

A guarantee is an unfunded product. This means that the financial instrument does not provide the loans themselves to the final recipients. Instead, a guarantee is given to one or more lenders, for instance commercial banks, which make the loans from their own resources, to the final recipients.

How do ERDF guarantee financial instruments work?

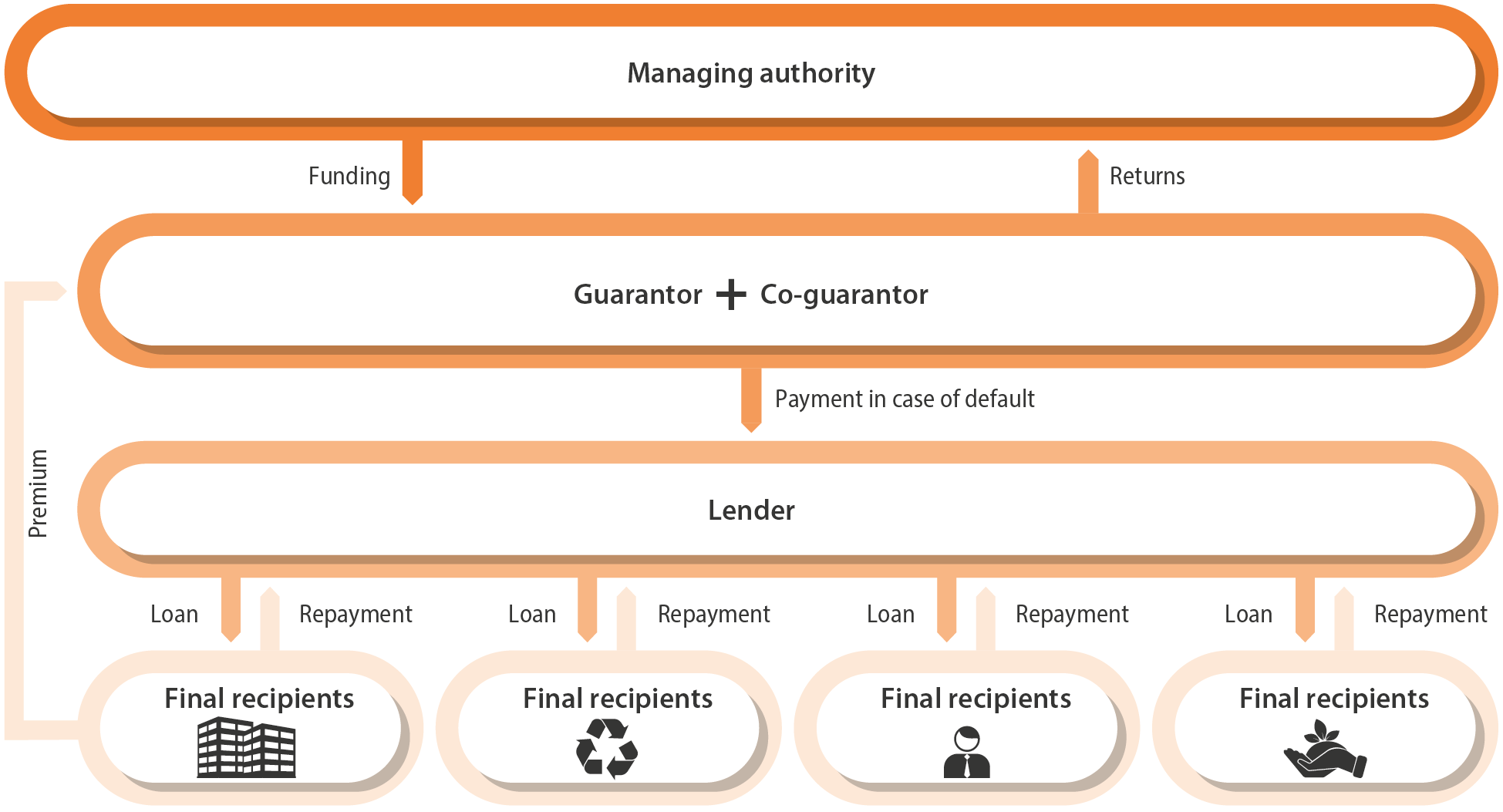

EU shared management funds are committed by a managing authority (or holding fund entrusted by the managing authority) to the body implementing the financial instrument which acts as guarantor.

In turn, the guarantor enters into a guarantee agreement with lenders (typically banks) to enable loans to be made to final recipients.

The guarantee can be provided for a guarantee fee or free of charge, depending on the policy objectives and the structure of the product.

Potential benefits for final recipients could include lower or no guarantee fees, lower or no collateral requirements as well as lower risk premiums.

Figure 2: Structure of a guarantee financial instrument

Types of guarantee

There are several different types of guarantee. The most common in the context of ERDF financial instruments is the portfolio guarantee where the guarantor covers the losses of a loan portfolio (i.e. a collection/group of loans) up to a certain level. In addition to loss coverage, this guarantee can reduce the capital required for the lending bank according to capital adequacy requirements in force.

Alternatively, a guarantee can be provided as an individual guarantee where the guarantor issues a direct guarantee for a specific loan for an agreed amount of debt to cover the losses of the lender in case of default.

A third type of guarantee is the counter-guarantee where one institution provides a guarantee to another institution to cover part of the risk of the latter’s guarantee operations.

Benefits of the guarantee

Revolving nature: allowing resources to be reused once they are released from the initial guarantee funding agreements.

Leverage effect: their ability to mobilise private sector financial resources.

Market orientated nature: well adapted to meet final recipients’ needs and are managed by financial intermediaries incentivised to achieve the objectives of the operation.

Rapid deployment: guarantee financial instruments often come with standardised and well-established processes familiar to banks, that can enable them to efficiently assess and process loan applications, reducing administrative overhead and accelerating the delivery of funds to borrowers.

More attractive lending conditions to final recipients: because the banks are required to transfer the financial benefit to the final recipients, they get improved conditions compared to what would be offered if they applied for standard market financing.

Huras: a rising star in challenging times

Thanks to a loan granted by BNP Paribas Bank Polska S.A of around EUR 1.7 million under the ERDF co-financed Biznesmax guarantee, Huras, a globally active family-owned company manufacturing machinery and specialised equipment in Nowa Wieś Legnicka, Poland, was able to develop and grow – even during challenging times.

The Biznesmax guarantee secured 80% of the loan while the loan covers ca. 74% of the investment costs. The loan helped to fund the construction of an additional production hall and a connector to the existing premises, an internal power line for plots and an external water, sanitary and rain sewage system.