The European Commission published its annual report summarising the progress made in financing and implementing financial instruments (FIs) supported by European Structural and Investment Funds (ESIF) for 2021.

Data collected is based on the reports made by the managing authorities in accordance with Article 46 of Common Provisions Regulation (CPR) (EU) No 1303/2013 of the European Parliament and of the Council (CPR), the Commission Implementing Regulation (EU) No 821/2014, and Fund-specific regulations. Below you can find the main conclusions and key messages for 2021.

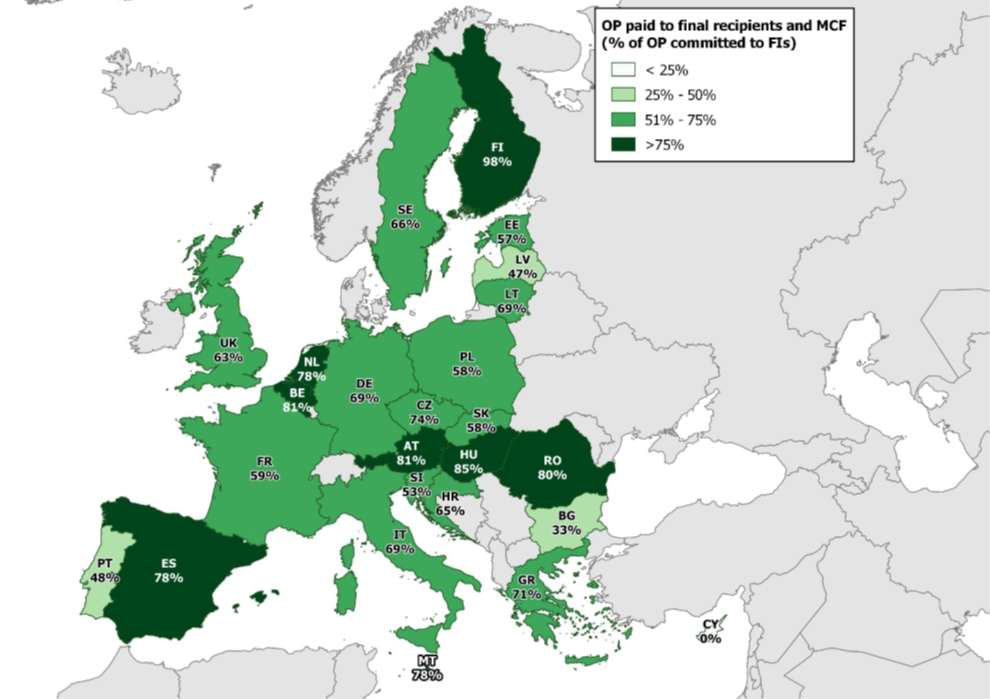

European Regional Development Fund (ERDF) and Cohesion Fund (CF) paid to final recipients in 2021 as percent of ERDF and CF committed to FIs.

The first positive news: the total programme contributions committed to FIs increased by almost EUR 1.9 billion by the end of 2021, to EUR 29.3 billion, including EUR 21.9 billion from the European Regional Development Fund (ERDF) and the Cohesion Fund (CF).

Similarly, supported final recipients increased by almost 122 000, to 678 000. Of these, SMEs were the largest group, with 592 500, of which 452 000 qualified as microenterprises. SMEs received support mostly through guarantees (435 000). Supported final recipients also included over 80 500 individuals, mostly receiving loans (51 500), and over 4 600 other final recipients.

Just like last year, the reported data highlights that the 2014-2020 regulatory framework has ensured a smooth and orderly implementation of ESIF financial instruments.

The European Regional Development Fund and Cohesion Fund FIs have proved to be a cost-efficient delivery mechanism of Union policies. The reported management costs and fees (MCFs) of 7.4% of the payment to final recipients lie significantly below the regulatory ceilings defined in the ESIF legal framework and in the legal framework of centrally managed financial instruments. Moreover, some 15% of the funds have already been paid back in reflows and can thus be reused in accordance with the CPR.

Almost EUR 50 billion financing up to 2021

The ability to attract additional resources is one of the key characteristics of FIs and one of the arguments for promoting their use to deliver ESIF policy objectives. The data for 2021 confirms previous encouraging findings in terms of the capacity of FIs to attract additional resources despite significant differences across Member States in the pace of FIs implementation.

Thus, in the end of 2021, FIs under ESIF have leveraged almost EUR 50 billion financing contributing to the policy objectives of the European Union, which almost quadruples the contribution from the EU budget. The largest mobilised financing was by far in Italy (EUR 17.3 billion), followed by Greece (EUR 6.1 billion), Spain (EUR 4.3 billion), Germany (EUR 3 billion) and Poland (EUR 2.8 billion).

Also, worth mentioning is the Croatian case. Although the 2014-2020 programming period is the first for Croatia as an EU Member State, the country managed to roll out a large number of successful financial instruments under EU Cohesion Policy. One of the best performing examples is the Croatian Venture Capital Initiative implemented in cooperation with the European Investment Fund.

A substantial increase in payments to final recipients

The publication’s key messages also indicated a substantial increase in payments from ERDF and CF to final recipients, by over a third when compared to that reported for end-2020, with an increase of almost EUR 3.5 billion. The largest increase was in Italy and Hungary each reporting over EUR 700 million of additional ESIF funds paid to final recipients. Poland also reported a substantial increase (EUR 495 million).

SMEs competitiveness, low-carbon economy and RDI still have the upper hand

The three most common Thematic Objectives according to commitments to FIs in the funding agreements remain:

- TO3 ‘Enhancing the competitiveness of small and medium-sized enterprises (SMEs)’ – EUR 14.9 billion

- TO4 ‘Supporting the shift towards a low-carbon economy in all sectors’ – EUR 2.1 billion

- TO1 ‘Strengthening research, technological development and innovation’ – EUR 2.1 billion

ERDF FIs allocated EUR 7 billion for working capital for SMEs in the light of COVID-19, which is double what the Member States allocated to working capital in the form of grants. Most SMEs received support through guarantees, while over 5 500 SMEs were supported through equity investments.

Lithuania: the green champion

Finally, the reported data shows that the ERDF financial instruments for supporting energy efficiency upgrades to multiapartment buildings in Lithuania is one of the best performing green FIs in the 2014-2020 period. The ERDF contribution of EUR 314 million successfully leveraged an additional EUR 838 million of private financing for financing more projects, which totals to EUR 1.1 billion of energy efficiency investment. The success of the energy efficiency FIs in Lithuania can largely be attributed to the fact that they are implemented in combination with grants, both in the form of technical assistance, interest rate subsidies and (mostly from national resources) as capital rebates.

Thanks to the Lithuanian Government’s ambitious Energy Efficiency renovation programme, which uses ERDF financial instruments, several thousands of multi-apartment buildings have been renovated in the country helping Lithuanian families to make 50 to 70% savings on their heating bills.

The actual payments made to final recipients registered an increase by almost 30% when compared to year 2019.

Agriculture and fishery FIs are also progressing

The implementation of EAFRD financial instruments is progressing well, also taking into account that the eligibility period for EAFRD FIs has been extended until the end of 2025. In 2021, 27 FIs paid money to final recipients (with 2 more than in 2020). MAs have reported EUR 321 million of RDP contributions committed for final recipients in loan contracts or set aside for guarantees.

The actual payments made to final recipients (or set aside for guarantees behind disbursed loans) amounted to EUR 289 million, an increase by almost 30% when compared to year 2019 (201 million), of which EUR 218 million (2019: 150 million) came from the EAFRD.

In addition, the data report indicates that the added flexibilities offered for FIs introduced in reaction to the Covid-19 health crisis, such as the provision of standalone working capital finance for affected SMEs aided the implementation of many instruments. It allowed the agricultural sector to secure liquidity, which helped farmers to overcome this period of crisis.

As far as the European Maritime and Fisheries Fund (EMFF) is concerned, payments to final recipients rose by 6% despite challenges present in 2021, with only Estonia having implemented financial instruments under the EMFF 2014-2020. Bulgaria started the process of setting up a financial instrument in March 2021, when the contract was signed between the Managing Authority and the Fund of Funds. The reported data also show that Bulgaria, Estonia, Finland, Croatia, Italy, Lithuania and Romania carried out ex ante assessments for the use of financial instruments under their EMFAF 2021-2027 programmes and are planning to implement financial instruments.