Since November 2021, the Green Eligibility Checker webtool, developed by the European Investment Bank (EIB) Advisory Services, helps answer this question.

Launched during the 26th UN Climate Conference (COP26) in Glasgow, and with financial support from the European Investment Advisory Hub, it aims to facilitate more green investment and financing across Europe. The EIB trusts that this innovative, on-line platform will serve as a reference point for financial institutions trying to keep up with European green finance standards.

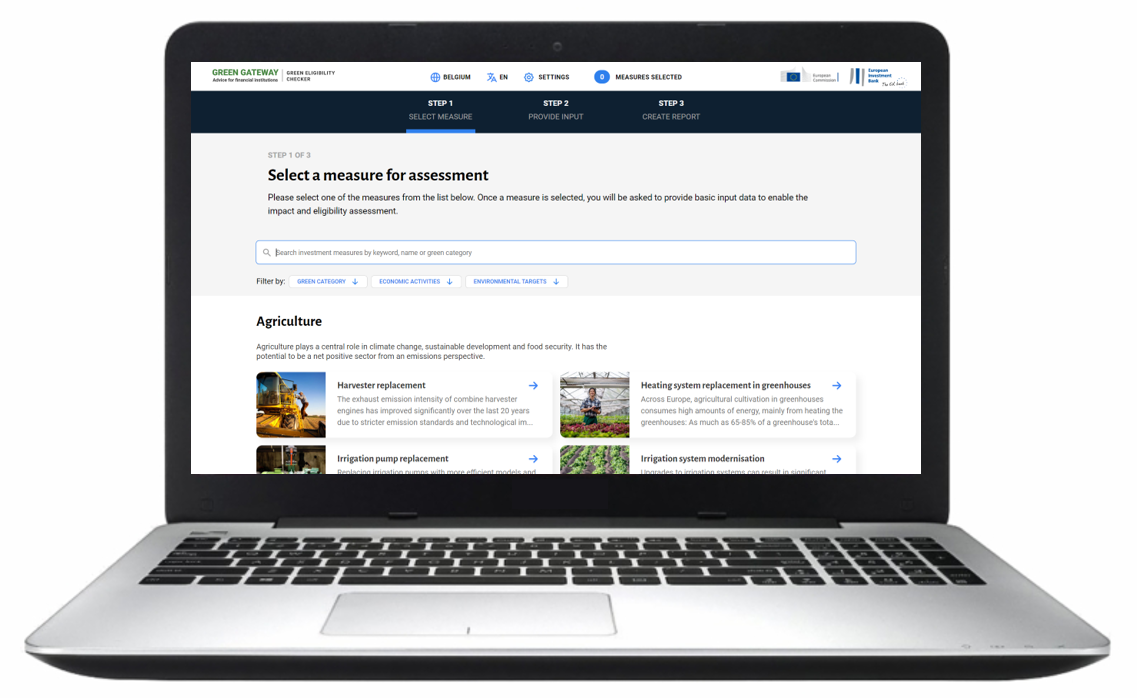

“With a limited number of data inputs, the EIB Green Eligibility Checker is user-friendly and intuitive. Users just need to select the location of their project, the investment measure(s) for assessment, provide some basic project information and then let the tool do the work”.

Frank Lee, Head of the Climate and Social Finance Advisory Division at EIB.

At the end of their assessment, users can receive a downloadable report that summarises whether their project meets EIB green eligibility criteria and what climate impact (e.g. possible CO2 or energy savings) it could be expected to achieve. Financial intermediaries can also use the report for internal purposes, for customer engagement, and for reporting back to the EIB of the usage of their funding.

Primarily targeted at financial intermediaries, such as commercial banks, leasing institutions or national promotional banks and institutions, the Green Eligibility Checker is available publicly and free of charge, meaning that other entities and individuals, including financial intermediary clients (including individuals, SMEs or even small public sector entities) can also use and benefit from it.

"Financial institutions need innovative solutions to first identify green investments in a simple way, and then to bring green loans to the market on a broad scale accordingly. Our Green Eligibility Checker, aims to strike a balance between ease of use and the reliability of the estimated climate impacts".

Maria Romano, Head of the Capacity Building Programmes Unit at the EIB Advisory Services.

What is behind the tool?

The Green Eligibility Checker contains a robust calculation engine, in the form of assessment methodologies for individual investment measures.

The methodologies integrate green eligibility rules for EIB intermediated lending products, the principles of the EU Taxonomy where applicable, and a set of climate impact calculations drawing on with country and region specific assumptions. To make the experience more user-friendly, the tool is now also accessible in six languages, namely English, French, German, Italian, Polish and Spanish.

Launched on 12 November 2021 at COP26 in Glasgow, the Green Eligibility Checker innovative online tool was recently highlighted by the European Investment Bank as a cornerstone of their green finance strategy.

“Our bank highly welcomes the EIB’s Green Eligibility Checker, which is easily accessible for everyone. The tool perfectly matches the needs of financial intermediaries and their corporate customers in making progress towards more sustainable finance. This user-friendly tool should set the pace for further “green” checkers from other central institutions involved in the European Green Deal”, say the Raiffeisenlandesbank Oberoesterreich green investments team.

Green finance for everyone

“By making the Green Eligibility Checker available free of charge and without registration, the EIB aims to also inspire and support a wider community of financial institutions, as well as other market players, while redirecting investment flows to more carbon-neutral projects”, stresses Roman Dojcak, Green Finance Advisor at the EIB, and who has coordinated the development of the web-tool. In parallel to developments in the EU taxonomy, the Green Eligibility Checker will also continue to evolve with a special focus on smaller scale green investment measures.

To learn more about the Green Eligibility Checker, visit their website and take a look at the EIB’s short intro video on the tool. The publication on Energy Efficiency/Renewable Energy model financial instrument combined with grants, undertaken for fi-compass, also allows for the use of the tool in such combination instruments targeting this subsector.