Nestled in the scenic Pomorskie Voivodeship on Poland’s Baltic coast, a pioneering regional public financial institution has been successfully promoting investments in renewable energy sources (RES). The history of Pomorski Fundusz Pożyczkowy (PFP, Pomorskie Loan Fund) dates back to 2004, the year Poland joined the EU.

Its track record encompasses 8 000 supported business and ventures worth EUR 162 million. In the 2014-2020 programming period, PFP has been the body implementing the ERDF-powered RES loan, selected by the European Investment Bank (EIB), the holding fund manager entrusted by the Marshal’s Office of the Pomorskie Voivodeship. The ERDF RES loan financial instrument in Pomorskie supported 137 projects of overall EUR 31 million, expanding the region’s renewable energy generation capacity by 40 megawatts.

Siled invested EUR 350,000 in photovoltaic panels installed on the roof of the production hall. The investment was co-financed by an RES loan (EUR 251,000) and the company’s own funds (EUR 97,800).

Poland is facing a complex transition away from fossil fuels that is integral to its environmental and economic future. The country has long been dependent on coal, with renewable energy sources accounting for merely 17% of its gross final energy consumption in 2022, meaning that Poland is lagging behind the EU average of 23%. The environmental consequences of the use of coal are particularly visible in urban landscapes. Most Polish cities are trapped in a cycle of severe air quality degradation due to excessive CO₂ emissions from coal-based heat production.

The region’s energy landscape further underscores the imperative need for change. Between 2021 and 2023, energy prices nearly doubled, while persistent coal dependency continued to strain both economic and environmental resources. In response, the introduction of the RES loan programme, co-financed from ERDF under Pomorskie’s regional Operational Programme, represents a targeted intervention designed to reverse these patterns. “The region’s persistent electricity deficit and the high energy intensity of public and residential infrastructure have made such innovative financing mechanisms not just desirable, but critically necessary for sustainable development,” says Ewelina Żaguń from the Marshal’s Office of the Pomorskie Voivodeship Regional and Spatial Development Department, Pomorskie’s regional self-governing administrative authority responsible for overseeing the region’s development. “The ERDF co-financed RES loan was designed to reduce dependence on coal, air pollution and rising energy prices, but also to stimulate economic revival in rural areas that are well suited for renewable energy development,” Żaguń adds.

Poland’s Pomorskie region had already broad experiences with ERDF financial instruments in the 2007-2013 programming period and decided to expand their use with 2014-2020 ERDF resources.

Ewelina Żaguń from the Marshal’s Office of the Pomorskie Voivodeship (Pomorskie’s ERDF managing authority): “The ERDF co-financed RES loan was designed to reduce dependence on coal, air pollution and rising energy prices, but also to stimulate economic revival in rural areas that are well suited for renewable energy development.”

Pomorskie’s strategic location

Pomorskie’s strategic location on the Baltic coast goes beyond attracting tourists. The region’s well-developed infrastructure, including the major ports of Gdańsk and Gdynia, combined with favourable wind conditions, has created an ideal environment for renewable energy generation. “The region boasts extensive opportunities for renewable energy facilities, including underused urban spaces, neglected agricultural lands and vast expanses of wasteland,” Ewelina Żaguń emphasises. Already outpacing national averages, 52% of energy generated in Pomorskie by 2019 was from renewable sources – an impressive feat – with renewable electricity making up 27.4% of the region’s total energy consumption. Despite this progress, Ewelina Żaguń notes a critical challenge: The region’s total energy production from all sources currently meets less than 53% of its energy needs.

Energising change

The Marshal’s Office of the Pomorskie Voivodeship, serving as the ERDF managing authority, entrusted the EIB as holding fund manager for three ERDF financial instruments in the 2014-2020 programming period. The EIB selected the regional development institution PFP as the body implementing the RES loan programme. The financial resources used for the RES loan instrument stemmed from the 2014-2020 ERDF Regional Operational Programme (EUR 27.5 million), EUR 2.5 million national co-financing and EUR 1 million from PFP. For more details on this loan financial instrument, read the recently published fi-compass case study.

PFP President Aneta Grzębska: “The RES loan fund, launched in partnership with the European Investment Bank, has been a game-changer.”

Source: fi-compass study

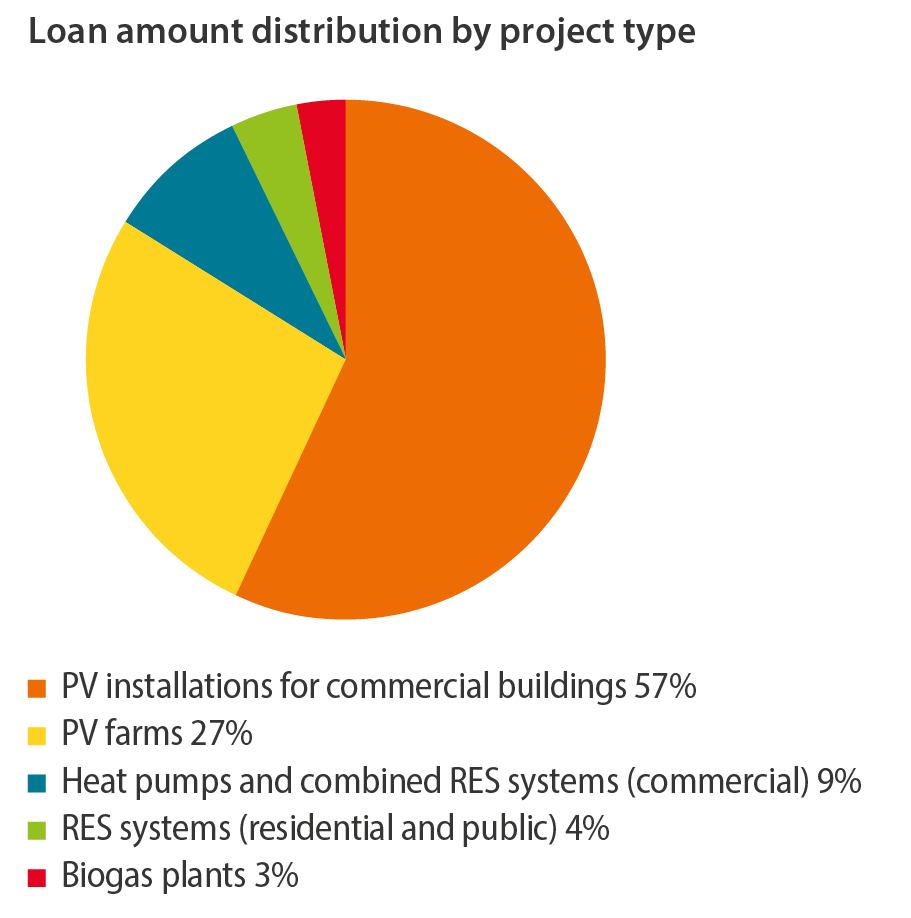

The RES programme supports a wide range of investments, from small installations for personal use to large-scale commercial operations. “Solar energy emerged as the clear frontrunner. Photovoltaic (PV) installations account for the majority of projects. We’ve successfully developed 20 solar farms and complexes, generating a combined capacity of 32.3 MW,” explains PFP President Aneta Grzębska. “With 137 projects in portfolio, our RES loan has become our flagship initiative – a powerful testament to our unwavering commitment to renewable energy,” she adds proudly.

Aside from its role in addressing financing gaps in renewable energy, a number of special features of the RES loan fund have contributed to its success. PFP has used its strong local presence to effectively market and distribute the loan to a wide range of investors, despite having limited prior experience in the renewable energy sector. A strategic partnership with the Baltic Agency for Energy Efficiency (BAPE) has provided crucial technical expertise, ensuring that only economically viable and impactful renewable energy initiatives receive funding.

Market dynamics also significantly influenced the implementation of the loan. Aneta Grzębska provides critical insight into the evolving landscape: “Initially, low energy prices and competitive commercial loan rates dampened market interest. The COVID-19 pandemic further complicated investment environments. However, from 2021, particularly following the war in Ukraine, interest in Pomorskie’s ERDF RES loan surged dramatically, driven by escalating fuel and energy prices and rising commercial interest rates,” she explains.

According to Ewelina Żaguń, the four pivotal factors driving the loan’s success were “professional support from PFP, substantially lower fixed interest rates (as low as 0.25% for projects in preferred areas) compared to commercial alternatives, flexible terms including extended repayment periods up to 15 years and maximum support amounts of up to of EUR 3.5 million.”

Aneta Grzębska elaborates on the loan distribution. “Most loans were extended at a highly preferential 0.25% fixed interest rate totalling EUR 29.5 million, with a smaller portion contracted at a still competitive 0.5% fixed rate,” she explains.

Thanks to Pomorskie’s ERDF RES loan, the plant now generates sufficient electricity through its PV installation to meet all of Siled’s internal energy needs.

Success story: Siled Sp. z o.o.

Siled, a well-established Polish company in Gdańsk, is one of the numerous beneficiaries of Pomorskie’s ERDF RES loan. For over 25 years, it has been a leading provider of high-quality electronics manufacturing services and is also a recognised manufacturer of LED fixtures and intelligent lighting management systems.

“The company contacted PFP in June 2019. The applicant prepared very professional documentation for the loan application. As the investment would have both economic and environmental benefits, we decided to proceed,” said Aneta Grzębska.

Siled invested EUR 350 000 in photovoltaic panels that were installed on the roof of the production hall. The investment was co-financed by an RES loan (EUR 251 000) and the company’s own funds (EUR 97 800).

“We signed the loan contract in May 2021 at a preferential interest rate of 0.25% and with a maturity of 180 months, including a six-month grace period,” says Andrzej Gawrychowski, General Director at Siled Ltd. He is pleased that the plant now generates sufficient electricity to meet all of its internal energy needs.

Looking to the future

Building on this success, Pomorskie is continuing its support for renewable energy in the 2021-2027 programming period through financial instruments. The new programme introduces innovative elements like support for energy storage systems and a preferential status for hybrid systems that use multiple renewable sources. Special emphasis is placed on projects within energy clusters and cooperatives, demonstrating the region’s commitment to community-based energy solutions.

For other regions considering similar initiatives, Pomorskie’s experience offers valuable lessons, demonstrating that it is important to ensure flexibility in financial instruments, simplify application procedures and cast a wide net in terms of eligible recipients. During FI Campus 2024, Ewelina Żaguń noted that “success lies in making these financial instruments both accessible and carefully tailored to the specific needs of renewable energy projects.”

“Through this innovative financing approach, Pomorskie is not just funding individual projects. It is catalysing a comprehensive transformation of its energy landscape. As regions across Europe seek ways to accelerate their transition to renewable energy, Pomorskie’s RES loan programme stands as a compelling model showing how thoughtful financial innovation can drive sustainable change,” said Agne Kazlauskaite, Economic and Policy Officer, Financial Instruments and International Financial Institutions Relations Unit, DG REGIO.

As PFP President Antea Grzębska reflects on the organisation’s 20-year journey, her vison for the future is clear: “We have consistently empowered Pomeranian entrepreneurs by unlocking EU financing opportunities. Our commitment to the ‘green economy,’ particularly in renewable energy, represents not just a funding strategy, but a fundamental pathway to regional economic and environmental resilience.”

Accelerating sustainable transformation – key messages from the FI Campus 2024 session on the role of financial instruments in decarbonising EU economies

Without decisive decarbonisation measures, the European Union is facing a potential 7% decline in GDP by the end of the century, according to Agne Kazlauskaite. Despite the European Green Deal’s ambitious goal of making Europe the first climate-neutral continent by 2050, the EU is not currently on track to meet its 2030 climate objectives. “We need to step up implementation efforts and accelerate emissions reduction because of geopolitical factors, escalating climate impacts and growing regional disparities across the EU,” she said at the last FI Campus event in Brussels. Recent floodings in Valencia and Central Europe underscore the critical need for investments in climate adaptation.

Agne Kazlauskaite highlighted several EU initiatives contributing towards environmental goals and that the EU has already made great strides through its Cohesion policy, having committed around EUR 120 billion to decarbonisation and climate action for the 2021-2027 programming period. She noted the growing trust in and efficiency of financial instruments, with funding allocations almost doubling and uptake of combined funding strategies seeing an increase in various Member states. However, she also emphasised that an additional EUR 100 billion in investments is still needed to progress effectively.

Agne Kazlauskaite highlighted several EU initiatives contributing towards environmental goals and that the EU has already made great strides through its Cohesion policy, having committed around EUR 120 billion to decarbonisation and climate action for the 2021-2027 programming period. She noted the growing trust in and efficiency of financial instruments, with funding allocations almost doubling and uptake of combined funding strategies seeing an increase in various Member states. However, she also emphasised that an additional EUR 100 billion in investments is still needed to progress effectively.

Recognising that energy efficiency often presents challenges for economically disadvantaged populations, Agne Kazlauskaite stressed that energy poverty remains a critical challenge for the EU. The Just Transition Mechanism is specifically designed to address these challenges. Nine Member States have expressed an interest in participating in the Just Transition Fund so far, demonstrating a will to address economic and environmental inequalities collaboratively.

The FI Campus 2024 session on decarbonisation of EU economies featured the example of the Pomorskie ERDF RES loan as well as further examples of financial instruments supporting decarbonisation from Czechia, Malta and Sweden Watch the full session here: FI Campus 2024 – Carrying the torch for financial instruments DAY 1