Small and young companies, such as Solutions for Nomads, have limited access to the capital market. With the help of the Micro Mezzanine Fund Germany (Mikromezzaninfonds Deutschland), a financial instrument financed from funds of the European Social Fund (ESF) and the ERP Special Fund (European Recovery Programme), Benjamin Brito, a young Argentinian, who arrived in Germany ten years ago, was able to open and develop his own van renovation business in Hamburg.

Born in Argentina in 1998, Benjamin Brito always had a passion for repairs and construction. In Buenos Aires, from a young age, he would work on his parents’ van and observe his father, a carpenter, making furniture.

“I did not expect such a success. Having so many clients asking for my services makes me extremely proud and grateful for the support I received from both my bank and MBG.”

Benjamin Brito, Founder of Solutions for Nomads.

But Argentina’s economic and political struggles led him and his family to leave their homeland in 2012 to find better opportunities in Europe. “First, we settled in Spain for two years and then moved to Hamburg where I have spent the last 10 years working as a carpenter”, he recalls. But after a tragic accident when he fell 10 meters to the ground, he made the decision to resume school and study furniture making. After graduating, he found a job in a company where he renovated camper vans.

“By then, in 2018, I was granted German citizenship and I had gained enough experience to start thinking about launching my own van renovation business. The hardest part was to find a place to open my garage and to identify the right customer offering and of course finding the proper financial support”, he remembers. With a good dose of hard work, resilience, and the support of the Bürgschaftsbank Hamburg, he was able to open his garage which he named Solutions for Nomads.

Much needed support for small companies’ growth

Benjamin only found out about the Micro Mezzanine Fund Germany two years later, when he decided to expand his garage and buy new materials: “I talked about the project to my bank, the Hamburger Sparkasse AG, and they advised to apply the micro mezzanine joint financing with MBG (Mittelständische Beteiligungs gesellschaft Hamburg mbH)”, explains the young entrepreneur who was granted a total credit of EUR 65 000, of which EUR 25 000 were financed via the Micro Mezzanine capital in the form of silent partnership.

Today, he must pay EUR 2 300 per month for the rental of his garage and a little more for the credit loan he took from his bank. “The good thing about the Micro Mezzanine capital is that I do not have to worry about repayment in the first few years, as the investment from the silent partnership must be repaid in three equal annual instalments from the 7th year onwards. After that, the silent partnership ends”, he explains.

Set up in 2013 by the German Federal Ministry for Economic Affairs and Climate Action using funds from the European Social Fund (ESF) and the German European Recovery Programme Special Fund, the Mikromezzaninfonds Deutschland financial instrument, provides mezzanine capital through silent partnerships. Further information on the design and structure of the instrument can be found in the fi-compass case study.

Mezzanine capital is a hybrid form of equity and debt capital. It takes the form of a silent partnership and provides a company with economic equity. This type of investment is like a loan, but the investor benefits from the profits of the enterprise: “We apply a fixed fee of 8.0 % p.a.; a variable profit participation of 1.5 % p.a; and a one-off processing fee of 3.5%”, says Katja Schütt, a Corporate Customer Advisor in the Credit Department of the Bürgschaftsbank Hamburg and the MBG Hamburg. Final recipients of the Mikromezzaninfonds are mainly small and medium sized micro-enterprises.

Especially small and micro-enterprises that provide training, commercially oriented social enterprises, or eco-oriented enterprises including start-ups as well as enterprises led by underrepresented people – e.g. women, people with a migration background or the unemployed – who are excluded from financial services as they have insufficient equity, or no credit history.

The financial intermediaries involved in the implementation of the financial instrument include 15 regional micro‑mezzanine investment companies, the ‘Mittelständische Beteiligungsgesellschaften’, or MBGs. Founded in the 1970s, these regional investment companies cover all of Germany and have since then supported SMEs from all sectors and especially start‑ups. The shareholders of the MBGs are chambers of commerce, business associations, banks and public development institutions owned by the German federal states.

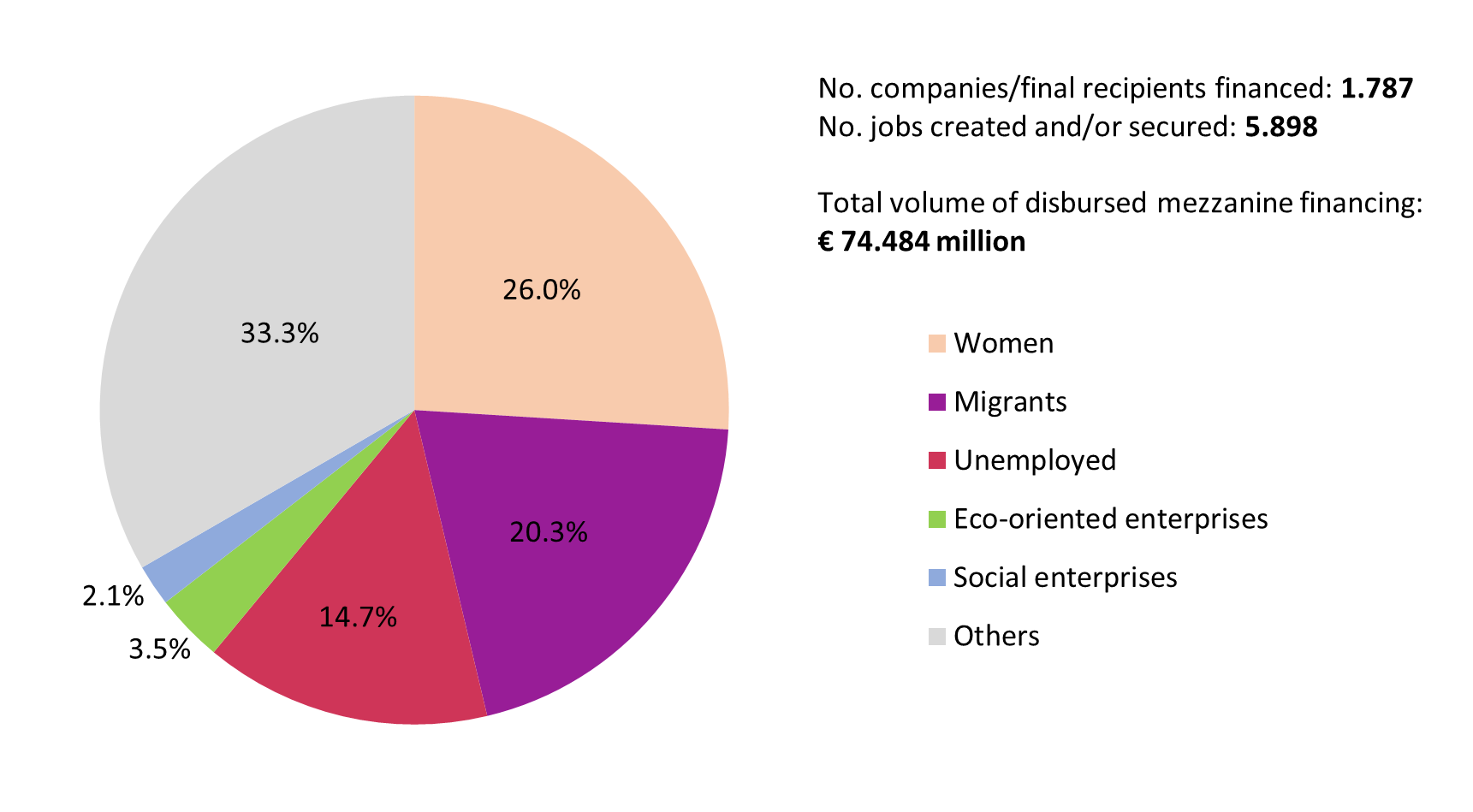

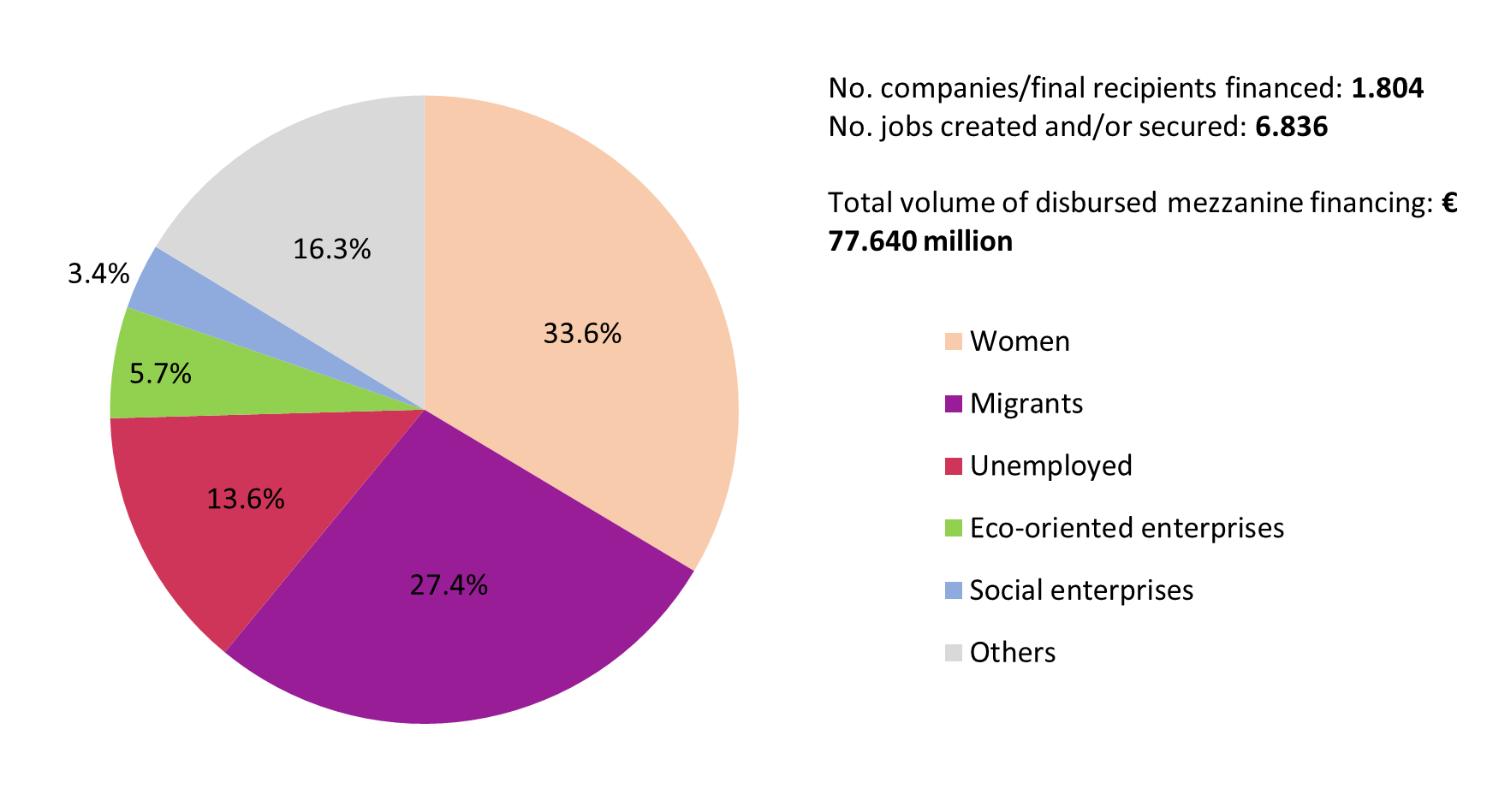

By December 2015, EUR 74.5 million had been disbursed to the final recipients through the Mikromezzaninfonds I (MMF I). Because of the demand and based on the recommendations of an ex-ante assessment, the financial instrument has been continuing in the 2014-2020 programming period (MMF II), providing another EUR 77million (ESF and national resources) for micro-mezzanine financing. The MMF III is planned to start in 2025 financed by the ESF Plus. Furthermore, the companies financed by the MMF II received additional support from REACT-EU in the form of interest subsidies.

The amount of the investment depends on whether a company belongs to one of the fund's specific target groups. For companies outside the target group, MBG can provide up to maximum of EUR 50 000. The initial funding is limited to EUR 75 000 per project. Furthermore, they do not interfere in the daily business of the supported company as there can be no entrance of third-party stockholders nor any dilution of shares.

“In the form of a typical silent partnership, we support company growth and investment financing, business successions, and start-ups with headquarters and investment location in Hamburg. Many MBG financings in the Hamburg SME sector are a result of the good cooperation between MBG and its shareholder banks”, explains Mrs Katja Schütt, while she adds: “Our customers come through several entry channels: directly through the website or through our financing bank partners in and around Hamburg.

Mikromezzaninfonds I (MMF I) as at 31.12.2023

We act as guarantors and provide default guarantees when securities are missing or insufficient in the financing plans. In doing so, we secure up to 80% of the loan and guarantee up to EUR 2 million per borrower unit. This often enables Hamburg-based entrepreneurs to gain the necessary access to financing and take the step towards self-employment”.

All investments requiring long-term financing are supported, such as the establishment of a new business, the continuation of an existing operation, working capital, or investments. “The financing project must be economically viable and based in Hamburg. If not, a significant job creation impact for Hamburg needs to be demonstrated”, stresses Mrs Schütt. So far, MBG has supported almost 150 companies with a total disbursement volume of over EUR 5,5 million, among which 18 are social enterprises.

“In collaboration with the house banks, MBG can offer "all from one source": a comprehensive financing package consisting of guaranteed debt capital and equity-like financing products including possible financing structuring” Katja Schütt, Corporate Customer Advisor in the Credit Department of the Bürgschaftsbank Hamburg and the MBG Hamburg.

"More than expected"

Today, Benjamin is proud of the growth of his company which was positively impacted by the COVID crisis: “Many people who had never travelled in a campervan before tried this hobby for the first time during the pandemic. Consequently, the number of potential customers has increased”, he explains while he goes on to say: “Our clients are experienced campers who have been unable to find a suitable recreational vehicle on the market and turn to us to build something that meets their expectations”. The range of renovations, pricing, and duration varies greatly at Solutions for Nomads. They undertake projects ranging from minor repairs to larger renovations. While Benjamin is proud of all the services his company can offer, one of his most significant projects to date was the renovation of a Mercedes Sprinter.

Feeling perfectly integrated in his new homeland, Benjamin Brito sees a bright future for his company. He even plans to recruit a couple of experienced builders to complement his team and sustain the company’s growth in addition to the two employees in Mini Jobs that he was able to recruit when he first started. “I would recommend this financial product to other entrepreneurs like me. It really gave a boost to my business”, he concluded with confidence.

Mikromezzaninfonds II (MMF II) as at 31.12.2023.

Note: auto-generated subtitles in English are available in the video settings.