Exploring new waters

The new fi-compass study on the use of financial instruments in the maritime and fisheries sector anticipates greater use of financial instruments to support the sector in the 2021-2027 period.

Based on feedback received from EMFF managing authorities and analysis of ex-ante assessment work undertaken by Member States, the fi-compass study on financial instruments financed by the European Maritime and Fisheries Fund (EMFF) 2014-2020 evaluates the use of EMFF financial instruments and explores the potential use of such tools after 2020.

Understanding key challenges

A total of 18 EMFF managing authorities from across the Union responded to the survey. The questions were designed to capture the experience of three main target groups, including: managing authorities that did not use financial instruments; managing authorities that did not use financial instruments but had completed an ex-ante assessment; and managing authorities that completed an ex-ante assessment and were keen to use financial instruments, as well as EMFF managing authorities that did use financial instruments.

The feedback received indicates that certain EMFF managing authorities have used this type of tool in the past programming periods (e.g. Bulgaria, Estonia, Latvia and Romania) or are considering the use of financial instruments post-2020.

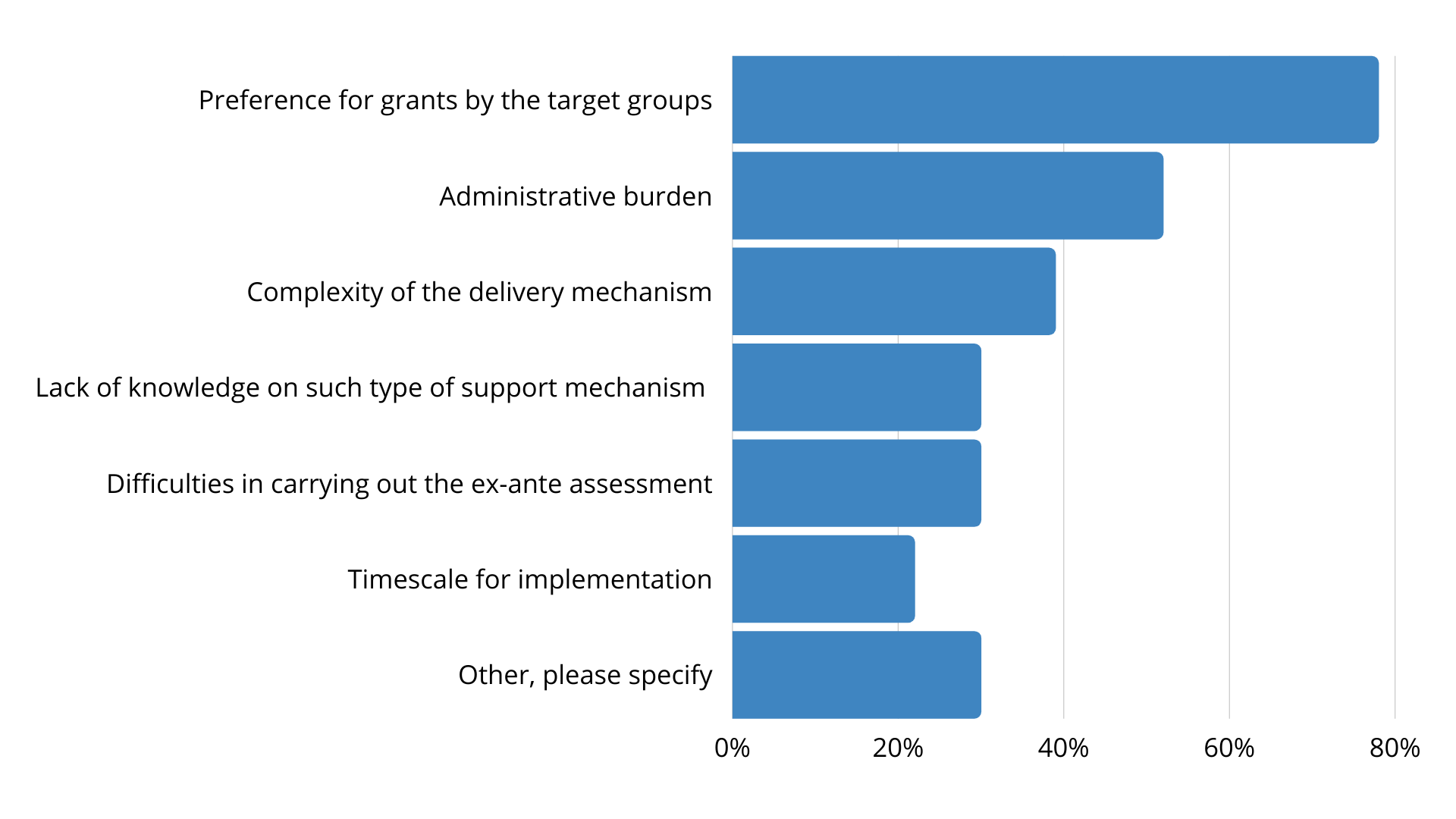

Some managing authorities did not make use of financial instruments, resulting from the target group’s preference for grants, the complexity of the delivery mechanism, administrative burden, the timeframe for implementation, and the small size of possible programme allocations combined with a lack of economies of scale.

The report reveals that 60% of survey respondents preferred greater use of those instruments under the new European Maritime Fisheries and Aquaculture Fund (EMFAF) for the 2021-2027 programming period. Member States that did not implement EMFF financial instruments indicated that this form of support has potential to be used in the future to provide assistance to new fishermen and aquaculture start-ups, as well as to contribute to the increased modernisation of facilities and equipment.

Many managing authorities, including Estonia, Finland, Bulgaria, Italy and Romania, are in the process of preparing their ex-ante assessments of financial instruments in their programmes. Thus, EMFAF stakeholders, including managing authorities’ staff, final recipients and financial intermediaries would benefit from capacity building support helpful to enhance their knowledge of financial instruments, contributing to increasing the uptake of financial instruments in the sector.

Learning the ropes

Respondents indicated that they would benefit from the organisation of workshops, seminars and online events alongside the provision of guidance notes from the European Commission, as part of a future capacity building support package. Managing authorities also responded to say that they would benefit from support throughout the financial instrument lifecycle. Experiences and lessons learnt from existing initiatives at EU and national level to support blue economy investments may provide a valuable source of inspiration on the design of future financial instruments under the EMFAF and at EU level under InvestEU.

The improved, more flexible, implementation options foreseen in the Common Provisions Regulation 2021 (CPR) will further allow EMFAF managing authorities to develop tailored support packages addressing the needs of final recipients.

The CPR’s and the EMFAF’s simplified rules will allow managing authorities to achieve important EU and national policy objectives, such as attract younger generations to the sector, avoid overfishing, enhance sustainable aquaculture, innovation and diversification, support the whole seafood value chain and achieve the goals of the Green Deal of a digital and green recovery from the pandemic.

For further information regarding the use of financial instruments in the maritime and fisheries sector, please see the full report, which is available on the fi-compass website.

In addition, the fi-compass podcast series ‘Calling the Tune’, is dedicated to explaining the novelties and flexibilities of the new CPR. This series offers managing authorities’ and interested stakeholders’ hands-on advice to start preparing and make the most of their 2021-2027 financial instruments.